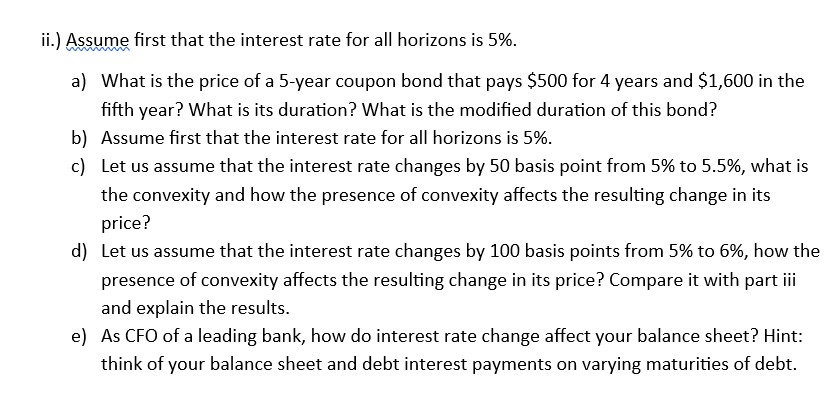

Question: ii . ) Assume first that the interest rate for all horizons is 5 % . a ) What is the price of a 5

ii Assume first that the interest rate for all horizons is a What is the price of a year coupon bond that pays $ for years and $ in the fifth year? What is its duration? What is the modified duration of this bond? b Assume first that the interest rate for all horizons is c Let us assume that the interest rate changes by basis point from to what is the convexity and how the presence of convexity affects the resulting change in its price? d Let us assume that the interest rate changes by basis points from to how the presence of convexity affects the resulting change in its price? Compare it with part iii and explain the results. e As CFO of a leading bank, how do interest rate change affect your balance sheet? Hint: think of your balance sheet and debt interest payments on varying maturities of debt.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock