Question: **(ii)** Question 4: Introduction to Risk and Return ( 25 marks) (i). Suppose you have $20,000 to invest in two securities: Spot and Dot. After

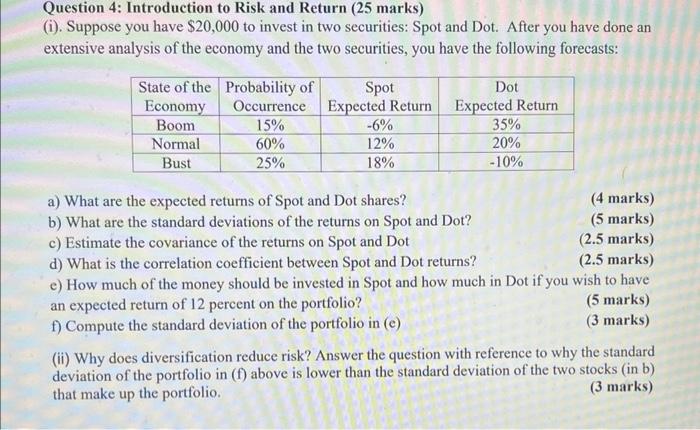

Question 4: Introduction to Risk and Return ( 25 marks) (i). Suppose you have $20,000 to invest in two securities: Spot and Dot. After you have done an extensive analysis of the economy and the two securities, you have the following forecasts: a) What are the expected returns of Spot and Dot shares? b) What are the standard deviations of the returns on Spot and Dot? c) Estimate the covariance of the returns on Spot and Dot d) What is the correlation coefficient between Spot and Dot returns? e) How much of the money should be invested in Spot and how much in Dot if you wish to have an expected return of 12 percent on the portfolio? f) Compute the standard deviation of the portfolio in (e) (5 marks) (ii) Why does diversification reduce risk? Answer the question with reference to why the standard deviation of the portfolio in ( f) above is lower than the standard deviation of the two stocks (in b) that make up the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts