Question: I'm having a hard time figuring out how to solve ending inventory. I would really appreciate it if someone could explain how they did it

I'm having a hard time figuring out how to solve ending inventory. I would really appreciate it if someone could explain how they did it in detail. Please and thank you.

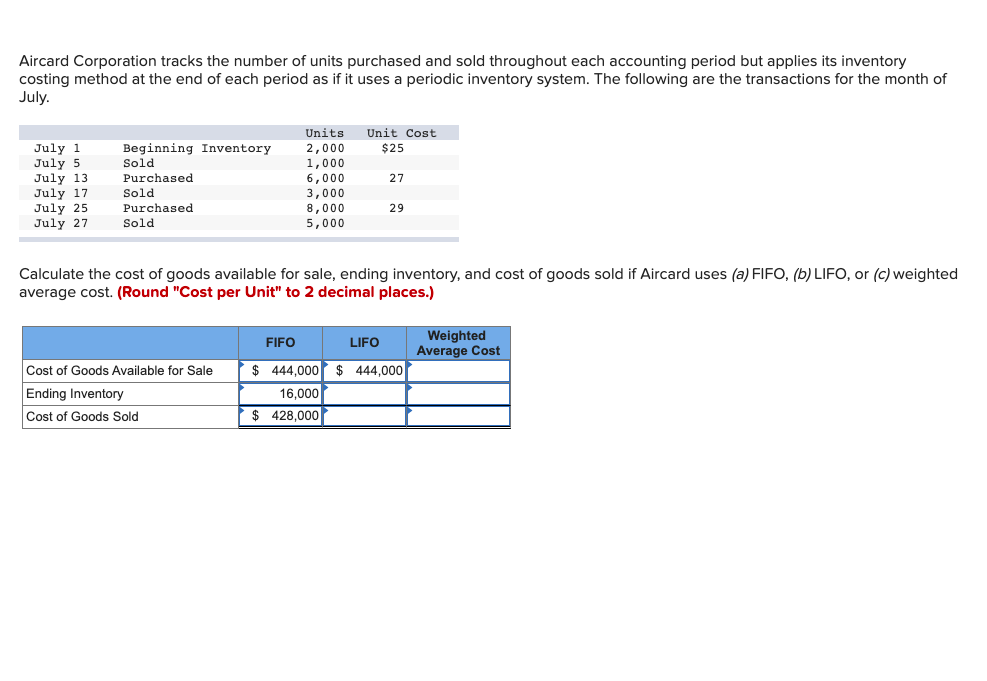

Aircard Corporation tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. The following are the transactions for the month of July Unit Cost $25 July 1 July 5 July 13 July 17 July 25 July 27 Beginning Inventory Sold Purchased Sold Purchased Sold Units 2,000 1,000 6,000 3,000 8,000 5,000 27 29 Calculate the cost of goods available for sale, ending inventory, and cost of goods sold if Aircard uses (a) FIFO, (b) LIFO, or (c) weighted average cost. (Round "Cost per Unit" to 2 decimal places.) FIFO LIFO Weighted Average Cost Cost of Goods Available for Sale $ 444,000 Ending Inventory Cost of Goods Sold $ 444,000 16,000 $ 428,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts