Question: im looking for help with problem 7-14 the values at the bottom of the second page go along with problem 7-14 on the othe page

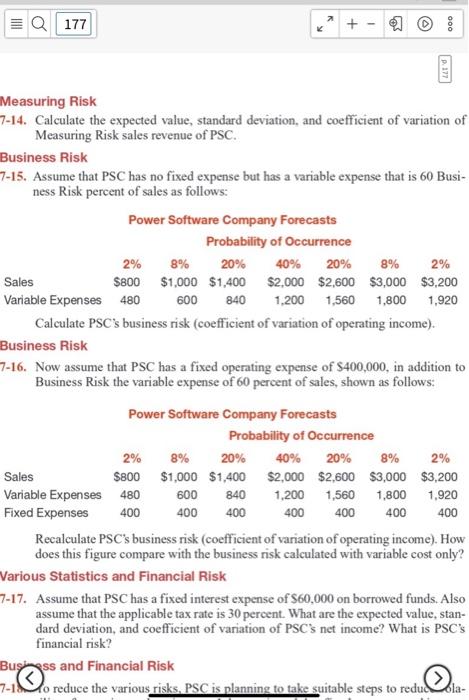

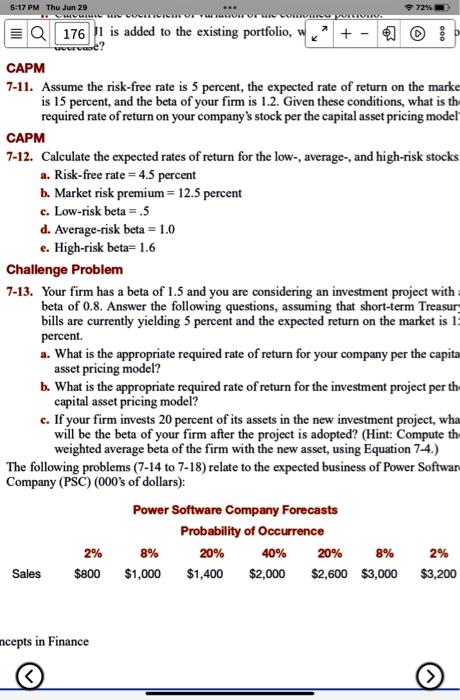

Measuring Risk 7-14. Calculate the expected value, standard deviation, and coefficient of variation of Measuring Risk sales revenue of PSC. Business Risk 7-15. Assume that PSC has no fixed expense but has a variable expense that is 60 Business Risk percent of sales as follows: Calculate PSC's business risk (coefficient of variation of operating income). Business Risk 7-16. Now assume that PSC has a fixed operating expense of $400,000, in addition to Business Risk the variable expense of 60 percent of sales, shown as follows: Recalculate PSC's business risk (coefficient of variation of operating income). How does this figure compare with the business risk calculated with variable cost only? Various Statistics and Financial Risk 7-17. Assume that PSC has a fixed interest expense of $60,000 on borrowed funds. Also assume that the applicable tax rate is 30 percent. What are the expected value, standard deviation, and coefficient of variation of PSC's net income? What is PSC's financial risk? Busimss and Financial Risk 7-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts