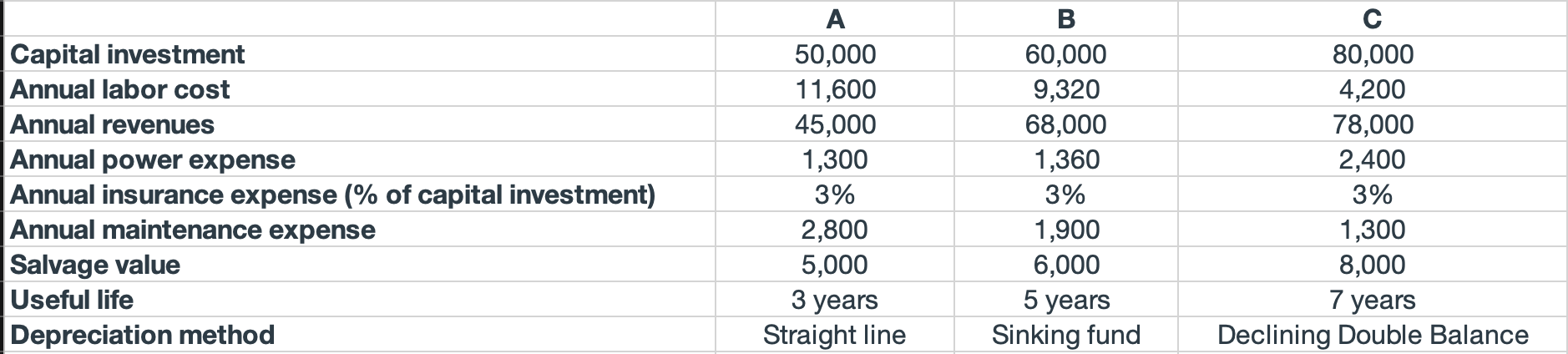

Question: In a restaurant, a manager is deciding an improvement project to increase the productivity. The net cash flows for the three feasible alternatives being compared.

In a restaurant, a manager is deciding an improvement project to increase the productivity. The net cash flows for the three feasible alternatives being compared. The period for analysis is 5 years, MARR for capital investments is 17% per year.

Using the ERR method, which alternative should be selected?

Compute for Book Value and incremental cash flow!

Thank you so much!!

?

Capital investment Annual labor cost Annual revenues Annual power expense Annual insurance expense (% of capital investment) Annual maintenance expense Salvage value Useful life Depreciation method A 50,000 11,600 45,000 1,300 3% 2,800 5,000 3 years Straight line B 60,000 9,320 68,000 1,360 3% 1,900 6,000 5 years Sinking fund C 80,000 4,200 78,000 2,400 3% 1,300 8,000 7 years Declining Double Balance

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

solution Solution select Altesnative ... View full answer

Get step-by-step solutions from verified subject matter experts