Question: IN EXCEL NOTATIONS! EXAMPLE: FOR FIRST =PMT(C8/12,C9,C7) A C C E Financial Functions 2 3 olete each task by inserting the appropriate function, referencing the

IN EXCEL NOTATIONS! EXAMPLE: FOR FIRST =PMT(C8/12,C9,C7)

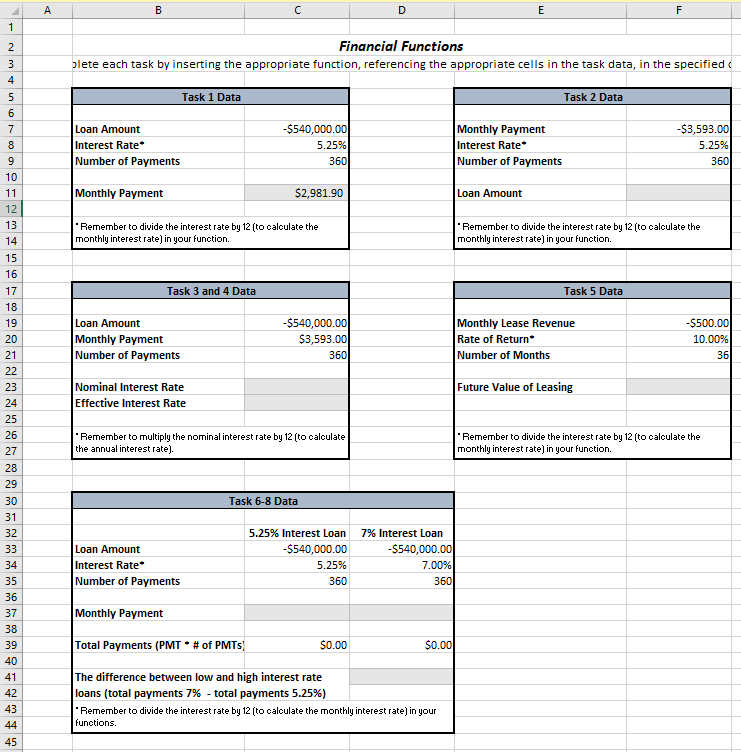

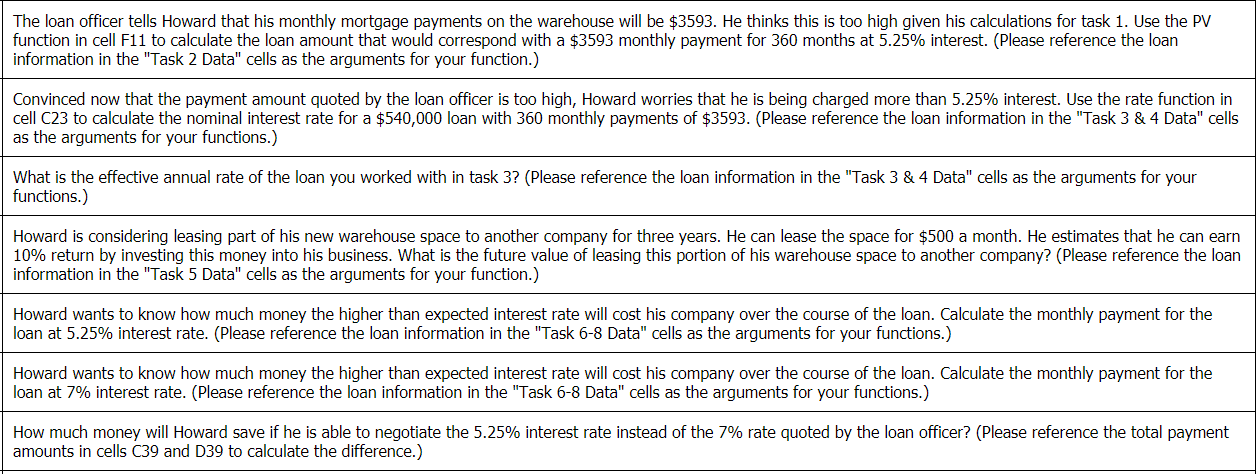

A C C E Financial Functions 2 3 olete each task by inserting the appropriate function, referencing the appropriate cells in the task data, in the specified 4 Task 1 Data Task 2 Data 6 -$3,593.00 -$540,000.00 5.25% 360 Monthly Payment Interest Rate Number of Payments Loan Amount 7 Interest Rate 8 5.25% Number of Payments 9 360 10 Monthly Payment Loan Amount $2,981.90 11 12 13 Remember to divide the interest rate by 12 (to calculate the monthly interest rate) in your function Remember to divide the interest rate by 12 (to calculate the monthly interest rate) in your function. 14 15 16 17 Task 3 and 4 Data Task 5 Data 18 -$500.00 -$540,000.00 $3,593.00 Monthly Lease Revenue Rate of Return Loan Amount Monthly Payment Number of Payments 19 20 10.00% 21 360 Number of Months 36 22 Nominal Interest Rate Future Value of Leasing 23 Effective Interest Rate 24 25 26 Remember to multiply the nominal interest rate by 12 (to calculate the annual interest rate]. Remember to divide the interest rate |12 (to caloulate the monthly interest rate) in your function. 27 28 29 30 Task 6-8 Data 31 32 5.25% Interest Loan 7% Interest Loan -$540,000.00 Loan Amount -$540,000.00 33 Interest Rate 34 5.25% 7.00% Number of Payments 360 35 360 36 Monthly Payment 37 38 Total Payments (PMT * #of PMTS $0.00 $0.00 39 40 The difference between low and high interest rate loans (total payments 7% - total payments 5.25%) 41 42 43 Remember to divide the interest rate by 12 (to calculate the monthly interest rate) in your functions. 44 45 m n a The loan officer tells Howard that his monthly mortgage payments on the warehouse will be $3593. He thinks this is too high given his calculations for task 1. Use the PV function in cell F11 to calculate the loan amount that would correspond with a $3593 monthly payment for 360 months at 5.25% interest. (Please reference the loan information in the "Task 2 Data" cells as the arguments for your function.) Convinced now that the payment amount quoted by the loan officer is too high, Howard worries that he is being charged more than 5.25% interest. Use the rate function in cell C23 to calculate the nominal interest rate for a $540,000 loan with 360 monthly payments of $3593. (Please reference the loan information in the "Task 3 & 4 Data" cells as the arguments for your functions.) What is the effective annual rate of the loan you worked with in task 3? (Please reference the loan information in the "Task 3 & 4 Data" cells as the arguments for your functions.) Howard is considering leasing part of his new warehouse space to another company for three years. He can lease the space for $500 a month. He estimates that he can earn 10% return by investing this money into his business. What is the future value of leasing this portion of his warehouse space to another company? (Please reference the loan information in the "Task 5 Data" cells as the arguments for your function.) Howard wants to know how much money the higher than expected interest rate will cost his company over the course of the loan. Calculate the monthly payment for the loan at 5.25% interest rate. (Please reference the loan information in the "Task 6-8 Data" cells as the arguments for your functions.) Howard wants to know how much money the higher than expected interest rate will cost his company over the course of the loan. Calculate the monthly payment for the loan at 7% interest rate. (Please reference the loan information in the "Task 6-8 Data" cells as the arguments for your functions.) How much money will Howard save if he is able to negotiate the 5.25% interest rate instead of the 7% rate quoted by the loan officer? (Please reference the total payment amounts in cells C39 and D39 to calculate the difference.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts