Question: Instructions Note: This problem is for the 2022 tax year. John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of

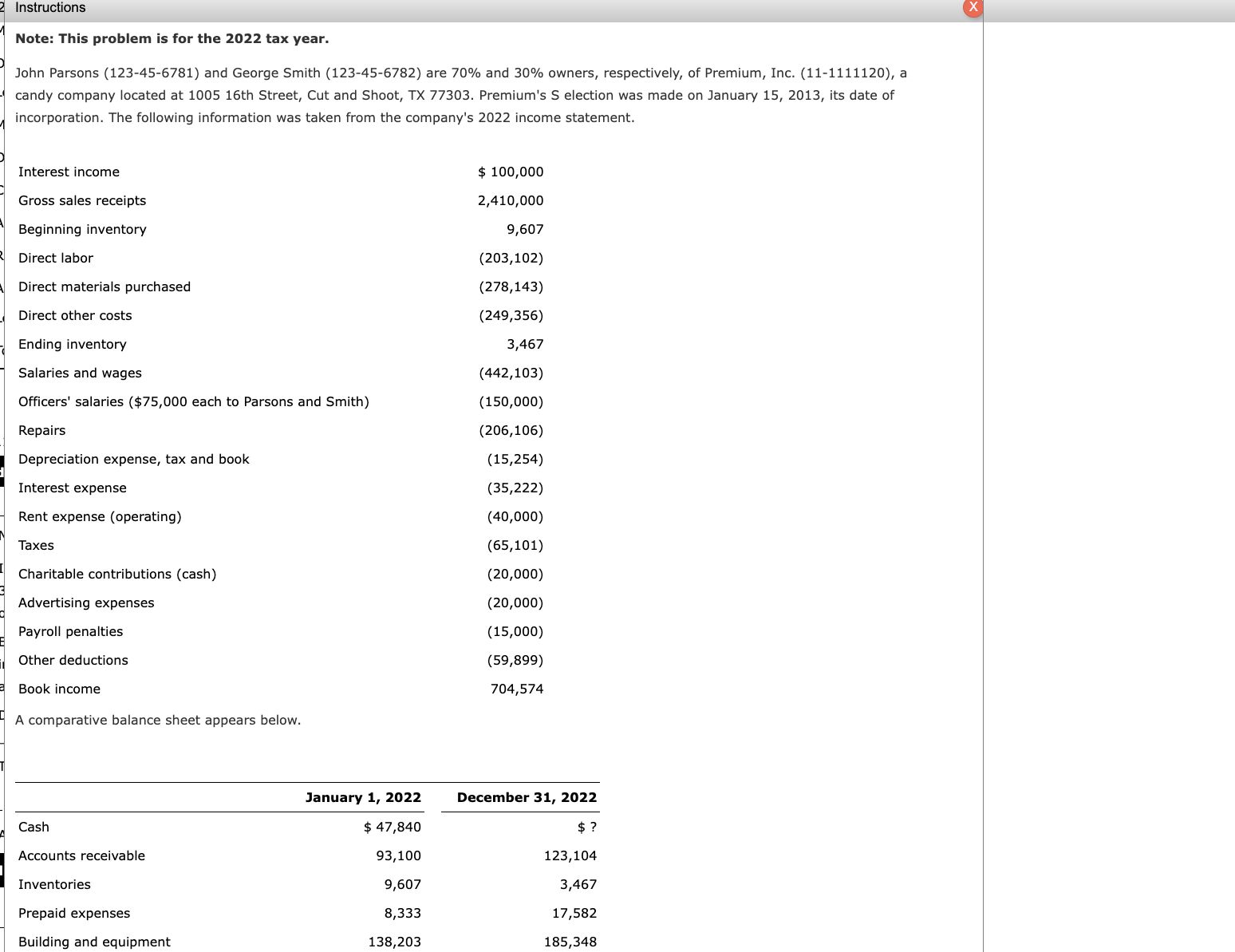

Instructions Note: This problem is for the 2022 tax year. John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111120), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Premium's S election was made on January 15, 2013, its date of incorporation. The following information was taken from the company's 2022 income statement. Interest income Gross sales receipts Beginning inventory Direct labor Direct materials purchased Direct other costs $ 100,000 2,410,000 9,607 (203,102) (278,143) (249,356) Ending inventory 3,467 Salaries and wages (442,103) Officers' salaries ($75,000 each to Parsons and Smith) (150,000) Repairs (206,106) Depreciation expense, tax and book (15,254) Interest expense (35,222) Rent expense (operating) (40,000) Taxes (65,101) Charitable contributions (cash) (20,000) Advertising expenses (20,000) Payroll penalties (15,000) Other deductions Book income A comparative balance sheet appears below. (59,899) 704,574 January 1, 2022 December 31, 2022 Cash Accounts receivable Inventories $ 47,840 $ ? 93,100 123,104 9,607 3,467 Prepaid expenses 8,333 17,582 Building and equipment 138,203 185,348

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to determine the following 1 Net Income Calculate net income using the income statement items provided 2 Change in Cash ... View full answer

Get step-by-step solutions from verified subject matter experts