Question: Instructions: Using the tables below, calculate Materiality and Tolerable Misstatement/Performance Materiality (PM) for each scenario using a layered materiality calculation approach. Remember to determine the

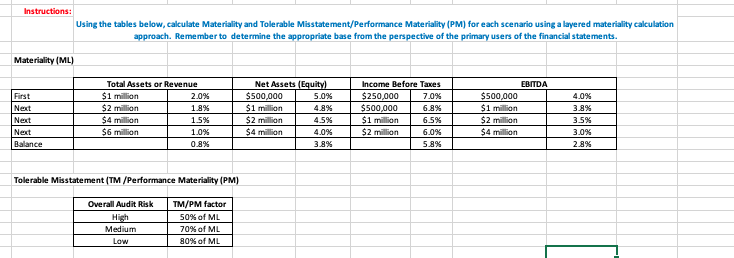

Instructions: Using the tables below, calculate Materiality and Tolerable Misstatement/Performance Materiality (PM) for each scenario using a layered materiality calculation approach. Remember to determine the appropriate base from the perspective of the primary users of the financial statements. Materiality ML) First Next EBITDA $500,000 $1 million Total Assets or Revenue $1 million 2.0% $2 million 1.8% $4 million $6 million 1.0% 0.8% Net Assets (Equity) $500.000 5.0% $1 million 4.8% $2 million 4.5% $ 4 million 4.0% 3.8% Income Before Taxes $250.000 7.0% $500,000 6.8% $1 million 6.5% $2 million 6.0% 5.8% 4.096 3.8% Next 3.5% $2 million $4 million 3.0% Next Balance 2.8% Tolerable Misstatement (TM/Performance Materiality (PM) Overall Audit Risk High Medium Low TM/PM factor 50% of ML 70% of ML 30% of ML Scenario 3 Background info: The client is a Public Company that builds residential homes. The company has a $100 million line of credit with a creditor. The lenders base the continuance of the line of credit on the value of the real estate held by the company. Current year client financial Information Total Assets Net Sales/Revenues Net Assets Income before taxes EBITDA Total Expenses $20 million $25 million N/A $7 million $835 million $18 million Overall Audit Risk High Appropriate base name base amount S ML STM/PM Amount of base X applied Applicable amount from ML table above First $ Next $ Nexts Next $ Balance Instructions: Using the tables below, calculate Materiality and Tolerable Misstatement/Performance Materiality (PM) for each scenario using a layered materiality calculation approach. Remember to determine the appropriate base from the perspective of the primary users of the financial statements. Materiality ML) First Next EBITDA $500,000 $1 million Total Assets or Revenue $1 million 2.0% $2 million 1.8% $4 million $6 million 1.0% 0.8% Net Assets (Equity) $500.000 5.0% $1 million 4.8% $2 million 4.5% $ 4 million 4.0% 3.8% Income Before Taxes $250.000 7.0% $500,000 6.8% $1 million 6.5% $2 million 6.0% 5.8% 4.096 3.8% Next 3.5% $2 million $4 million 3.0% Next Balance 2.8% Tolerable Misstatement (TM/Performance Materiality (PM) Overall Audit Risk High Medium Low TM/PM factor 50% of ML 70% of ML 30% of ML Scenario 3 Background info: The client is a Public Company that builds residential homes. The company has a $100 million line of credit with a creditor. The lenders base the continuance of the line of credit on the value of the real estate held by the company. Current year client financial Information Total Assets Net Sales/Revenues Net Assets Income before taxes EBITDA Total Expenses $20 million $25 million N/A $7 million $835 million $18 million Overall Audit Risk High Appropriate base name base amount S ML STM/PM Amount of base X applied Applicable amount from ML table above First $ Next $ Nexts Next $ Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts