Question: Intermediate. A B D E F G H Taylor Tools is a privately held company that has been in operations for over a decade. The

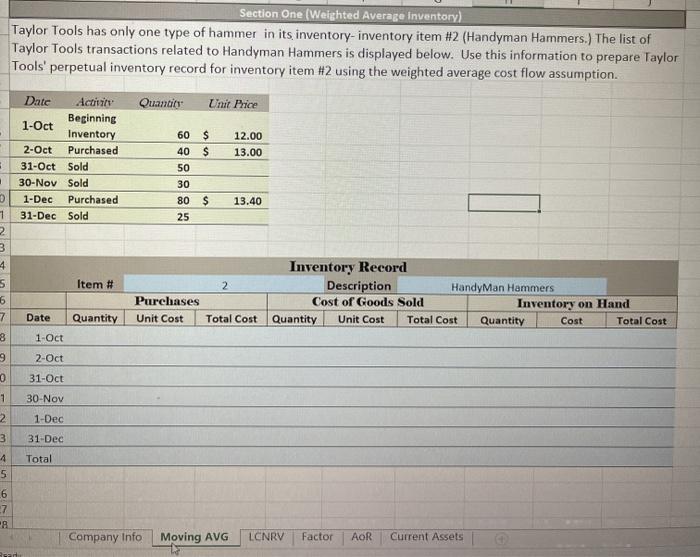

A B D E F G H Taylor Tools is a privately held company that has been in operations for over a decade. The company sells two types of tools to local hardware stores, hand tools and power tools. Taylor manufactures the power tools internally at their headquarters but outsources production of their hand tools to other smaller companies due to production constraints. The following information is pertinent to Taylor's accounting system: Taylor uses the weighted-average (or moving average) inventory method for determining the value of its inventory on hand and the amount of cost of goods sold the company records on sales. Because Taylor Tools has elected to use weighted-average cost flow assumption, it uses the lower-of-cost-or-net-realizable-value method to determine if it needs to write down the value of the company's inventory. * Taylor has a long standing business relationship with Wentworth Factors and frequently sells this factor a portion of their outstanding receivables. Due to this positive relationship, Wentworth gives Taylor very favorable finance rates when they do business. Taylor Tools uses the aging-of-receivables method for determing the company's 1 3 4 7 9 0 1 2 3 24 25 26 27 28 Section One (Weighted Average Inventory) Taylor Tools has only one type of hammer in its inventory-inventory item #2 (Handyman Hammers.) The list of Taylor Tools transactions related to Handyman Hammers is displayed below. Use this information to prepare Taylor Tools' perpetual inventory record for inventory item #2 using the weighted average cost flow assumption. Quando Unit Price . 12.00 13.00 Date Actite Beginning 1-Oct Inventory 2-Oct Purchased 31-Oct Sold 30-Nov Sold 1-Dec Purchased 31-Dec Sold . 60 $ 40 $ 50 30 80 $ 25 1 D 13.40 1 3 4 Item # 2 S 6 Inventory Record Description HandyMan Hammers Cost of Goods Sold Inventory on Hand Quantity Unit Cost Total Cost Quantity Cost Total Cost Purchases Unit Cost 7 Date Quantity Total Cost 8 1-Oct 9 2-Oct 0 31-Oct 30-Nov 1 1-Dec 3 31-Dec Total 4 5 6 7 8 Company Info Moving AVG LCNRV Factor AOR Current Assets Read

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts