Question: Is chosen selection correct? Question 16 Given the following data from a Comparative Competitive Efforts page in the CIR: Your Industry Your Company WHOLESALE SEGMENT

Is chosen selection correct?

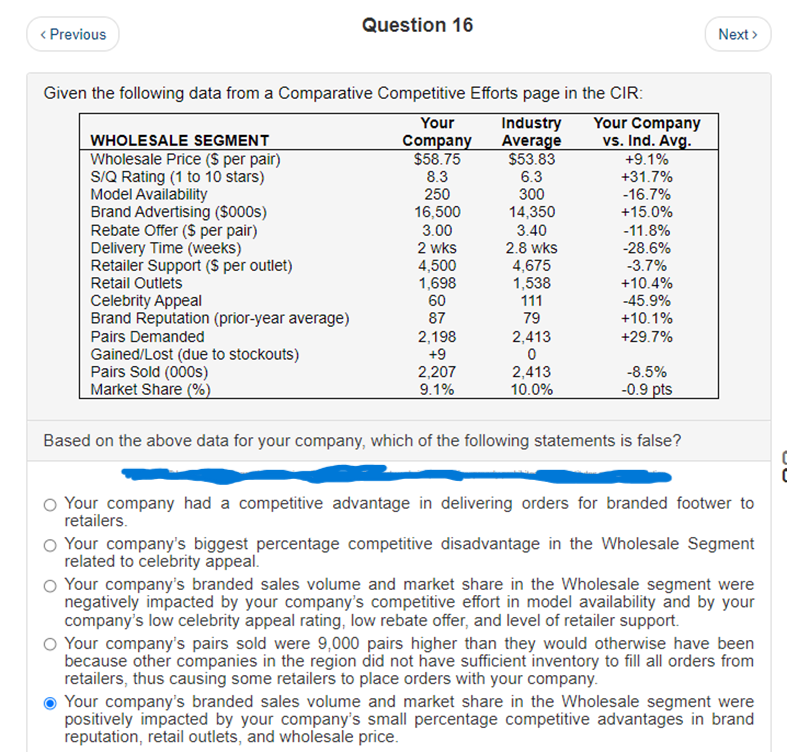

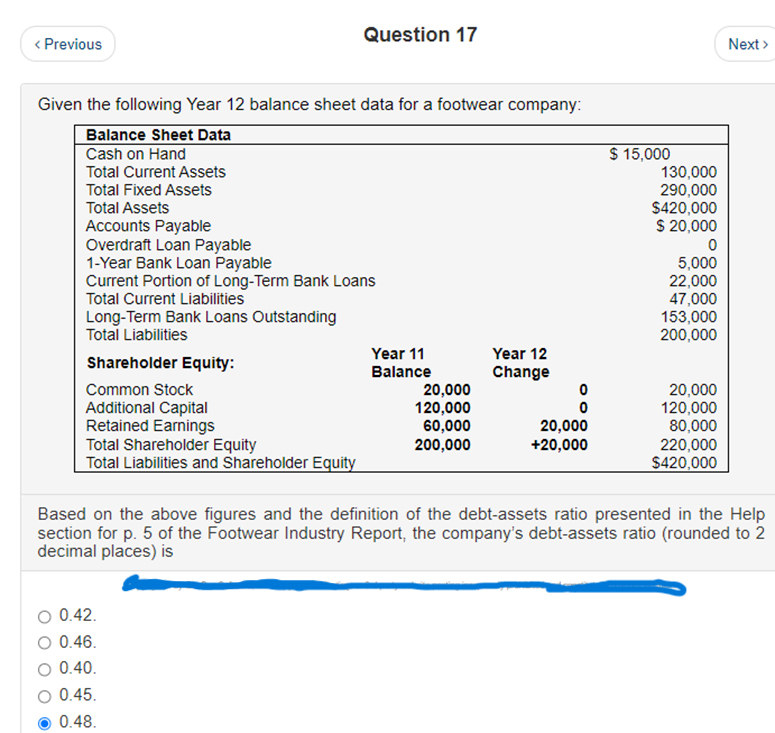

Question 16 Given the following data from a Comparative Competitive Efforts page in the CIR: Your Industry Your Company WHOLESALE SEGMENT Company Average vs. Ind. Avg. Wholesale Price (s per pair) $58.75 $53.83 +9.1% S/Q Rating (1 to 10 stars) 8.3 6.3 +31.7% Model Availability 250 300 -16.7% Brand Advertising ($000s) 16,500 14,350 +15.0% Rebate Offer ($ per pair) 3.00 3.40 -11.8% Delivery Time (weeks) 2 wks 2.8 wks -28.6% Retailer Support (s per outlet) 4,500 4,675 -3.7% Retail Outlets 1,698 1,538 +10.4% Celebrity Appeal 60 111 -45.9% Brand Reputation (prior-year average) 87 +10.1% Pairs Demanded 2,198 2,413 +29.7% Gained/Lost (due to stockouts) +9 0 Pairs Sold (000s) 2,207 2,413 -8.5% Market Share (%) 9.1% 10.0% -0.9 pts 79 Based on the above data for your company, which of the following statements is false? Your company had a competitive advantage in delivering orders for branded footwer to retailers. Your company's biggest percentage competitive disadvantage in the Wholesale Segment related to celebrity appeal. Your company's branded sales volume and market share in the Wholesale segment were negatively impacted by your company's competitive effort in model availability and by your company's low celebrity appeal rating, low rebate offer, and level of retailer support. Your company's pairs sold were 9,000 pairs higher than they would otherwise have been because other companies in the region did not have sufficient inventory to fill all orders from retailers, thus causing some retailers to place orders with your company. Your company's branded sales volume and market share in the Wholesale segment were positively impacted by your company's small percentage competitive advantages in brand reputation, retail outlets, and wholesale price. Given the following Year 12 balance sheet data for a footwear company: Balance Sheet Data Cash on Hand Total Current Assets Total Fixed Assets Total Assets Accounts Payable Overdraft Loan Payable 1-Year Bank Loan Payable Current Portion of Long-Term Bank Loans Total Current Liabilities Long-Term Bank Loans Outstanding Total Liabilities Shareholder Equity: Year 11 Year 12 Balance Change Common Stock 20,000 0 Additional Capital 120,000 0 Retained Earnings 60,000 20,000 Total Shareholder Equity 200,000 +20,000 Total Liabilities and Shareholder Equity $ 15,000 130,000 290,000 $420,000 $ 20,000 0 5,000 22,000 47,000 153,000 200,000 20,000 120,000 80,000 220,000 $420,000 Based on the above figures and the definition of the debt-assets ratio presented in the Help section for p. 5 of the Footwear Industry Report, the company's debt-assets ratio (rounded to 2 decimal places) is 0.42 O 0.46. O 0.40. 0.45. 0.48

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock