Question: ITEM SET 9: 403(b) PLAN: Manuel, age46, is a physics teacher at a local public high school. Manuel has been with the school for 21

ITEM SET 9: 403(b) PLAN: Manuel, age46, is a physics teacher at a local public high school. Manuel has been with the school for 21 years, earns $65,000 per year, and has never participated in the 403(b)-retirement plan. The 403(b) plan matches contributions dollar for dollar. A 457 plan is being considered by the school district.

Please answer the following questions and explain your answers.

1. Which plan will provide Manuel with the highest tax deferral in 2022?

2. If Manuel's spouse earns enough money to support them and they decide to save as much of his income as possible, how much can he defer in tax-deferred retirement savings vehicles assuming the school adopts the 457 plan?

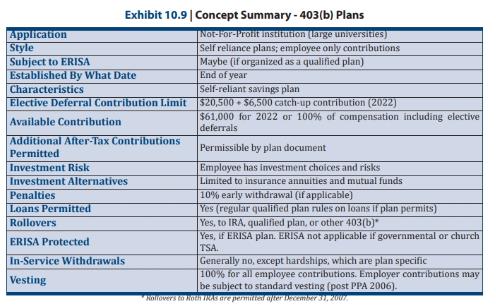

3. What kinds of investments can Manuel make in his 403(b) plan?

4. What types of employers can participate in a 403(b) plan?

5. What types of employees benefit the most from the implementation of a 403(b) plan?

Reference - (Retirement Planning & Employee Benefits book - Chapter 10: SIMPLE, 403(b), and 457 Plan):

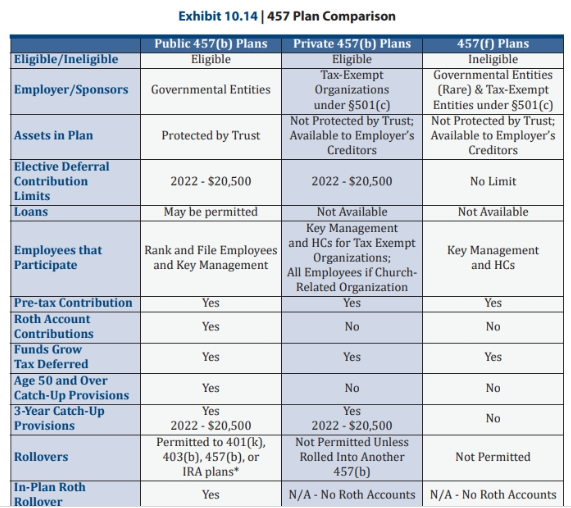

Eligible/Ineligible Employer/Sponsors Assets in Plan Elective Deferral Contribution Limits Loans Employees that Participate Pre-tax Contribution Roth Account Contributions Funds Grow Tax Deferred Age 50 and Over Catch-Up Provisions 3-Year Catch-Up Provisions Rollovers In-Plan Roth Rollover Exhibit 10.14 | 457 Plan Comparison Private 457(b) Plans Eligible Tax-Exempt Organizations Public 457(b) Plans Eligible Governmental Entities Protected by Trust 2022-$20,500 May be permitted Rank and File Employees and Key Management Yes Yes Yes Yes Yes 2022-$20,500 Permitted to 401(k), 403(b), 457(b), or IRA plans* Yes under 501(c) Not Protected by Trust; Available to Employer's Creditors 2022 - $20,500 Not Available Key Management and HCs for Tax Exempt Organizations; All Employees if Church- Related Organization Yes No Yes No Yes 2022-$20,500 457(f) Plans Ineligible Governmental Entities (Rare) & Tax-Exempt Entities under $501(c) Not Protected by Trust; Available to Employer's Creditors No Limit Not Available Key Management and HCs Yes No Yes No No Not Permitted Unless Rolled Into Another 457(b) N/A - No Roth Accounts N/A - No Roth Accounts Not Permitted

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

The plan that will provide Manuel with the highest tax deferral in 2022 would be the 403b plan This ... View full answer

Get step-by-step solutions from verified subject matter experts