Question: JER Team Assignment - Compatibility Mode Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments FNCE Evaluate the financial statement for

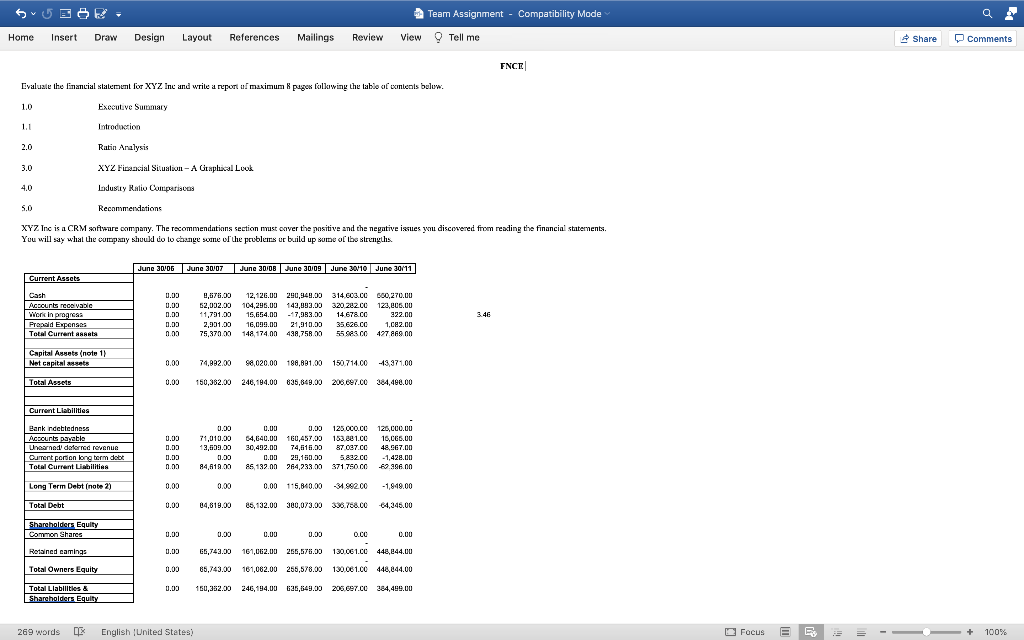

JER Team Assignment - Compatibility Mode Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments FNCE Evaluate the financial statement for XYZ ine and write a report u maximum 8 pages folkwing the labio of contents below. 1.0 Executive Summary 1.1 Introduction 2.0 Ratin Analysis 3.0 XYZ Financial Situation - A Gitaplucal Look 4.0 Ladusty Ratio Compariscos 5.0 Recommendations XYZ Inc is a CRM Software company. The recommendations section must cover the positive and the negative issues you discovered from reading the financial statements. You will say what the company should do longe soone of the problems or build up some of the strengths. June 2006 June 2007 June 2008 June 20/09 June 2010 June 30/1 Current Assets Cash Accounts recevable Wer in progress Prepaid Expenses Total Current Anna 0.03 0.00 0.00 0.00 n.00 4,670.00 12,126.00 290,9411.39 314.603.CO 314.603.CO 600,270.00 52,002.00 104,295.00 149,999.00 320.282.00 123,000.00 11,791.00 15,654.00 -17,983.00 14.678.CC 222.00 2,901.00 16,099.00 21,913.00 35 626.CC 1,082.00 75,370.00 148 174.00 438,758.00 55 sesco 427.869.00 3.46 Capital Assets (note 1) Net capital assets 0.02 74,892.00 98,020.00 188,881.00 150 714.00 -13,971,00 Total Assets 0.00 150,382.00 246,194.00 835,848.00 208.cer.co 384,488.00 Current Liabilities Bank ndebtedness Accounts payabia Unaarned deferred revenue Current portion long term doty Total Current Liabilities 0.03 0.03 0.03 n.o 0.00 71,010.00 13,599.00 0.00 84,619.00 0.00 0.00 125.000.CC 54,640.00 160,457.00 153.801.00 30,492.00 74,516.30 87 007 CC 0.00 29,150.00 5.832.00 85 137.00 264,233.00 371 780.00 125,000.00 15,066.00 48,567.00 - 1,429.00 -69.986.00 Long Term Debt (note 2) 0.03 0.00 0.00 115,840.00 31.982.cc -1,819,00 Total Debt 0.00 84,819.00 86,132.00 300,073.00 398.788.00 -64,345.00 0.02 0.00 0.00 0.00 O.CO 0.00 Shareholders Equity Common Shares Rotained caminas 0.03 65,743.00 161,062.00 265,576.00 130.061.CO 448,244.00 Total Owners Equity 0.00 85,743.00 161,062.00 265,678.00 130.061.CO 448,044.00 0.00 Total Liabilities & Shareholders Equity 160,352.00 246,194.00 626,649.00 246,194.00 626,649.00 208.67.CO 205.687.co 384,499.00 269 words LE English United States Focus + 100% JER Team Assignment - Compatibility Mode Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments FNCE Evaluate the financial statement for XYZ ine and write a report u maximum 8 pages folkwing the labio of contents below. 1.0 Executive Summary 1.1 Introduction 2.0 Ratin Analysis 3.0 XYZ Financial Situation - A Gitaplucal Look 4.0 Ladusty Ratio Compariscos 5.0 Recommendations XYZ Inc is a CRM Software company. The recommendations section must cover the positive and the negative issues you discovered from reading the financial statements. You will say what the company should do longe soone of the problems or build up some of the strengths. June 2006 June 2007 June 2008 June 20/09 June 2010 June 30/1 Current Assets Cash Accounts recevable Wer in progress Prepaid Expenses Total Current Anna 0.03 0.00 0.00 0.00 n.00 4,670.00 12,126.00 290,9411.39 314.603.CO 314.603.CO 600,270.00 52,002.00 104,295.00 149,999.00 320.282.00 123,000.00 11,791.00 15,654.00 -17,983.00 14.678.CC 222.00 2,901.00 16,099.00 21,913.00 35 626.CC 1,082.00 75,370.00 148 174.00 438,758.00 55 sesco 427.869.00 3.46 Capital Assets (note 1) Net capital assets 0.02 74,892.00 98,020.00 188,881.00 150 714.00 -13,971,00 Total Assets 0.00 150,382.00 246,194.00 835,848.00 208.cer.co 384,488.00 Current Liabilities Bank ndebtedness Accounts payabia Unaarned deferred revenue Current portion long term doty Total Current Liabilities 0.03 0.03 0.03 n.o 0.00 71,010.00 13,599.00 0.00 84,619.00 0.00 0.00 125.000.CC 54,640.00 160,457.00 153.801.00 30,492.00 74,516.30 87 007 CC 0.00 29,150.00 5.832.00 85 137.00 264,233.00 371 780.00 125,000.00 15,066.00 48,567.00 - 1,429.00 -69.986.00 Long Term Debt (note 2) 0.03 0.00 0.00 115,840.00 31.982.cc -1,819,00 Total Debt 0.00 84,819.00 86,132.00 300,073.00 398.788.00 -64,345.00 0.02 0.00 0.00 0.00 O.CO 0.00 Shareholders Equity Common Shares Rotained caminas 0.03 65,743.00 161,062.00 265,576.00 130.061.CO 448,244.00 Total Owners Equity 0.00 85,743.00 161,062.00 265,678.00 130.061.CO 448,044.00 0.00 Total Liabilities & Shareholders Equity 160,352.00 246,194.00 626,649.00 246,194.00 626,649.00 208.67.CO 205.687.co 384,499.00 269 words LE English United States Focus + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts