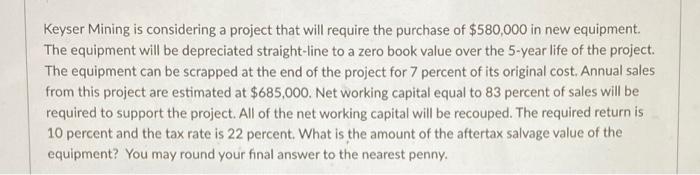

Question: Keyser Mining is considering a project that will require the purchase of $580,000 in new equipment The equipment will be depreciated straight-line to a zero

Keyser Mining is considering a project that will require the purchase of $580,000 in new equipment The equipment will be depreciated straight-line to a zero book value over the 5-year life of the project. The equipment can be scrapped at the end of the project for 7 percent of its original cost, Annual sales from this project are estimated at $685,000. Net working capital equal to 83 percent of sales will be required to support the project. All of the net working capital will be recouped. The required return is 10 percent and the tax rate is 22 percent. What is the amount of the aftertax salvage value of the equipment? You may round your final answer to the nearest penny

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts