Question: May's risk aversion score is 2.09. Abbys risk aversion score is 9.54 Assets Expected returns Standard deviation a 10% 7% b 16% 10% 6. Evaluate

May's risk aversion score is 2.09.

Abbys risk aversion score is 9.54

| Assets | Expected returns | Standard deviation |

| a | 10% | 7% |

| b | 16% | 10% |

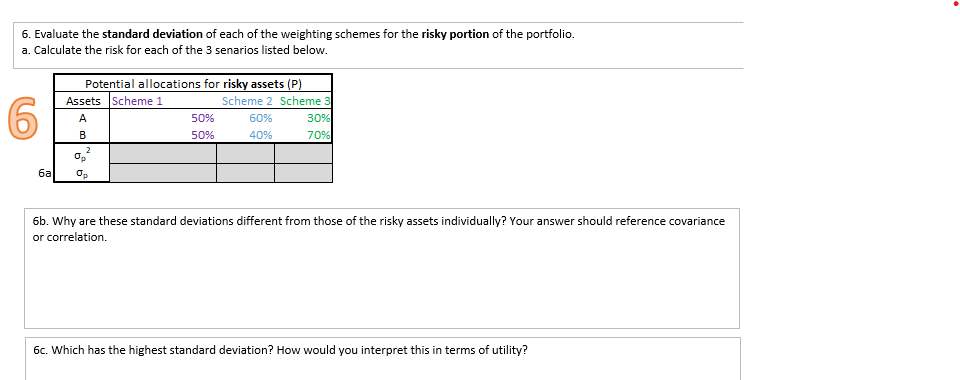

6. Evaluate the standard deviation of each of the weighting schemes for the risky portion of the portfolio. a. Calculate the risk for each of the 3 senarios listed below. 6i 6b. Why are these standard deviations different from those of the risky assets individually? Your answer should reference covariance or correlation. 6c. Which has the highest standard deviation? How would you interpret this in terms of utility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts