Question: undefined Case 3 (10 marks) Following is the schedule and graph of parameters required by an average investor to achieve mean variance optimization. D Optimal

undefined

undefined

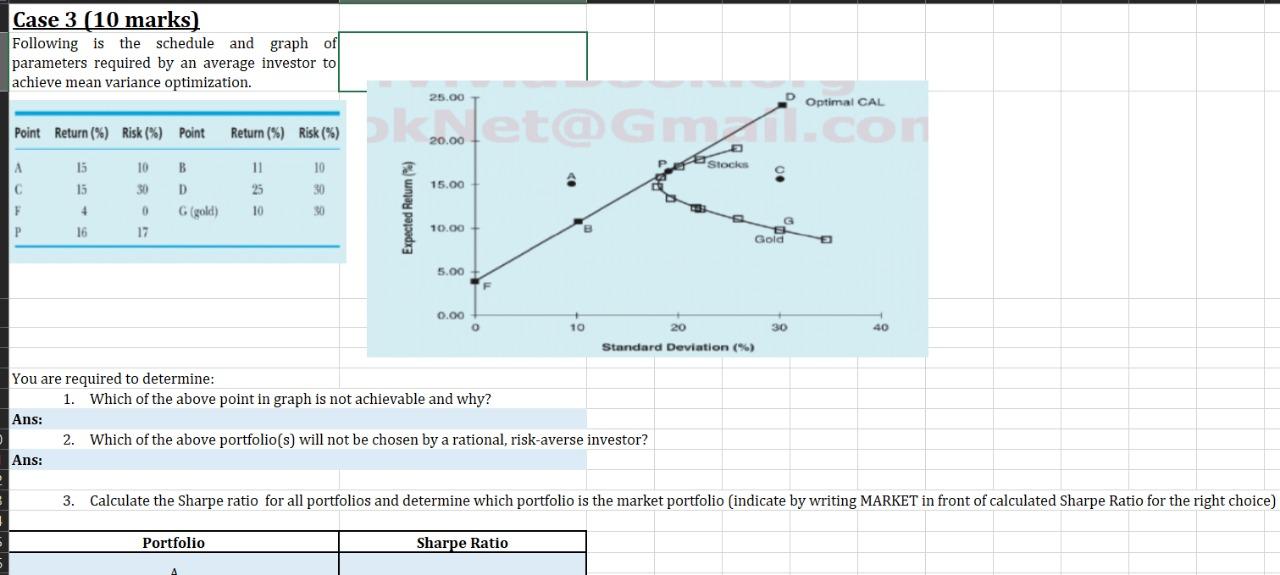

Case 3 (10 marks) Following is the schedule and graph of parameters required by an average investor to achieve mean variance optimization. D Optimal CAL Point Return (%) Risk (%) Point Return (%) Risk (%) bilete etGM 10 B 11 PREStocks 15 15 10 20 C. a 30 D 25 15.00 F 4 0 G (gold) 10 30 Expected Return) 10.00 P 16 17 Gold 5.00 0.00 10 20 30 40 Standard Deviation (%) You are required to determine: 1. Which of the above point in graph is not achievable and why? Ans: 2. Which of the above portfolio(s) will not be chosen by a rational, risk-averse investor? Ans: 3. Calculate the Sharpe ratio for all portfolios and determine which portfolio is the market portfolio (indicate by writing MARKET in front of calculated Sharpe Ratio for the right choice) Portfolio Sharpe Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts