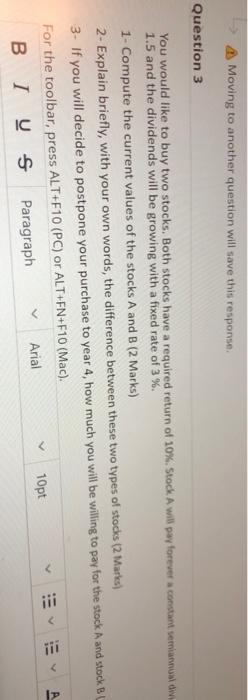

Question: Moving to another question will save this response Question 3 You would like to buy two stocks. Both stocks have a required return of 10%.

Moving to another question will save this response Question 3 You would like to buy two stocks. Both stocks have a required return of 10%. Stock A will pay forever a constantemwandi 1.5 and the dividends will be growing with a fixed rate of 3 %. 1- Compute the current values of the stocks A and B (2 Marks) 2- Explain briefly, with your own words, the difference between these two types of stocks (2 Marks) 3- you will decide to postpone your purchase to year 4, how much you will be willing to pay for the stock and stock B For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I US Paragraph Arial 10pt V A V Moving to another question will save this response Question 3 You would like to buy two stocks. Both stocks have a required return of 10%. Stock A will pay forever a constantemwandi 1.5 and the dividends will be growing with a fixed rate of 3 %. 1- Compute the current values of the stocks A and B (2 Marks) 2- Explain briefly, with your own words, the difference between these two types of stocks (2 Marks) 3- you will decide to postpone your purchase to year 4, how much you will be willing to pay for the stock and stock B For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I US Paragraph Arial 10pt V A V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts