Question: need help with 6 and 7 Question 6 (1 point) Jamison Insurance's stock currently sells for $18.00 a share. It just paid a dividend of

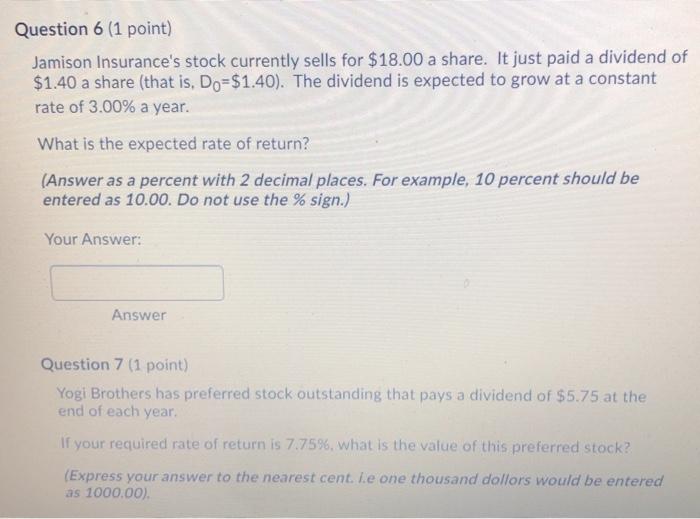

Question 6 (1 point) Jamison Insurance's stock currently sells for $18.00 a share. It just paid a dividend of $1.40 a share (that is, Do=$1.40). The dividend is expected to grow at a constant rate of 3.00% a year. What is the expected rate of return? (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.) Your Answer: Answer Question 7 (1 point) Yogi Brothers has preferred stock outstanding that pays a dividend of $5.75 at the end of each year. If your required rate of return is 7.75%6, what is the value of this preferred stock? (Express your answer to the nearest cente one thousand dollors would be entered as 1000.00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts