Question: need solutions for questions for case study from chapter 9 - Diversifying and managing acquisitions globally from the book Global strategy 4th edition by Peng

need solutions for questions for case study from chapter 9 - Diversifying and managing acquisitions globally from the book Global strategy 4th edition by Peng

Subject - Organizational strategy

Questions are as follows,

- Why have firms from China and India significantly expanded their international footprint?

- Why do they focus on industries related to their existing areas of excellence?

- Why are they interested in acquisitions?

- Firms from which of the two countries (China, India) will be more successful in the long run in making good acquisitions? Why?

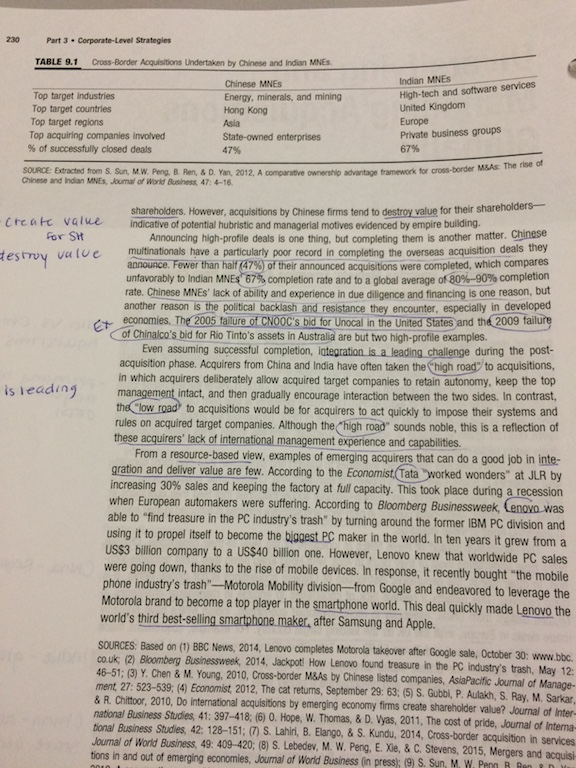

f G Case #5 OPENING CASE Emerging Markets: Emerging Acquirers from China and India Multinational enterprises (MNES) from emerging economies, especially China and India, have emerged as a new breed of acquirers around the world. Provoking "oohs" and "ahhs," they have ind grabbed media headlines and caused controversies. Anecdotes aside, what are the patterns of these new global acquirers? How do they differ? Only recently has rigorous academic research been conducted to allow for systematic comparison (Table 9.1). Overall, China's stock of outward foreign direct investment (OFDI) (1.7% of the worldwide total) is more than three times that of India (0.5%). One visible similarity is that both Chinese and Indian MNEs seem to use acquisitions as their primary mode of OFDI. Throughout the 2000s, Chinese firms spent US$130 billion to engage in acquisitions overseas, whereas Indian firms made acquisition deals worth US$60 billion. MNEs from China and India target industries to support and strengthen their own most compet- itive industries at home. Given China's prowess in manufacturing, Chinese firms' overseas acquisitions primarily target energy, minerals, and mining crucial supply industries that feed their operations at home. Indian MNEs' world-class position in high-tech and software services is reflected in their interest in acquiring firms in these industries. The geographic spread of these MNES is indicative of the level of their capabilities. Chinese firms have undertaken most of their deals in Asia, with Hong Kong being their most favorable loca- tion. In other words, the geographic distribution of Chinese acquisitions is not global; rather, it is . quite regional. This reflects a relative lack of capabilities to engage in managerial challenges in regions distant from China, especially in more-developed economies. Indian MNEs have primarily made deals in Europe, with the UK as the leading target country. For example, acquisitions made by Tata Motors (Jaguar Land Rover (JLR]) and Tata Steel (Corus Group) propelled Tata Group to become the number-one private sector employer in the UK. Overall, Indian firms display a more global spread in their acquisitions, and demonstrate a higher level of confidence and sophistication in making deals in developed economies. From an institution-based view, the contrasts between the leading Chinese and Indian acquirers are significant. The primary players from China are state-owned enterprises (SOES), which have their own advantages (such as strong support from the Chinese government and trappings (such as resentment and suspicion from host-country governments). The movers and shakers of cross- border acquisitions from India are private business groups, which generally are not viewed with strong suspicion. The limited evidence suggests that M&As by Indian firms tend to create value for their 230 Part 3. Corporate-Level Strategies TABLE 9.1 Cross-Border Acquisitions Undertaken by Chinese and Indian MNES Top target industries Top target countries Top target regions Top acquiring companies involved % of successfully closed deals Chinese MNES Energy, minerals, and mining Hong Kong Asia State-owned enterprises 47% Indian MNES High-tech and software services United Kingdom Europe Private business groups 67% SOURCE: Extracted from s. sun, mw. Peng. B. Ren, & D. Yan, 2012, A comparative ownership advantage framework for cross-border MBAs: The rise of Chinese and Indian MNES, Journal of World Business, 47: 4-16. destroy value shareholders. However, acquisitions by Chinese firms tend to destroy value for their shareholders- create value indicative of potential hubristic and managerial motives evidenced by empire building. for SH Announcing high-profile deals is one thing, but completing them is another matter. Chinese multinationals have a particularly poor record in completing the overseas acquisition deals they announce. Fewer than half (47%) of their announced acquisitions were completed, which compares unfavorably to Indian MNES 67% completion rate and to a global average of 80%-90% completion rate. Chinese MNES' lack of ability and experience in due diligence and financing is one reason, but another reason is the political backlash and resistance they encounter, especially in developed economies. The 2005 failure of CNOOC's bid for Unocal in the United States and the 2009 failure of Chinalco's bid for Rio Tinto's assets in Australia are but two high-profile examples. Even assuming successful completion, integration is a leading challenge during the post- acquisition phase. Acquirers from China and India have often taken the "high road to acquisitions, in which acquirers deliberately allow acquired target companies to retain autonomy, keep the top is leading management intact, and then gradually encourage interaction between the two sides. In contrast, the low road to acquisitions would be for acquirers to act quickly to impose their systems and rules on acquired target companies. Although the "high road" sounds noble, this is a reflection of these acquirers' lack of international management experience and capabilities From a resource-based view, examples of emerging acquirers that can do a good job in inte- gration and deliver value are few. According to the Economist (Tata worked wonders" at JLR by increasing 30% sales and keeping the factory at full capacity. This took place during a recession when European automakers were suffering. According to Bloomberg Businessweek, Cenovo was able to find treasure in the PC industry's trash" by turning around the former IBM PC division and using it to propel itself to become the biggest PC maker in the world. In ten years it grew from a US$3 billion company to a US$40 billion one. However, Lenovo knew that worldwide PC sales were going down, thanks to the rise of mobile devices. In response, it recently bought the mobile phone industry's trash"--Motorola Mobility division--from Google and endeavored to leverage the Motorola brand to become a top player in the smartphone world. This deal quickly made Lenovo the world's third best-selling smartphone maker, after Samsung and Apple. SOURCES: Based on (1) BBC News, 2014, Lenovo completes Motorola takeover after Google sale, October 30: www.bbc. co.uk (2) Bloomberg Businessweek, 2014, Jackpot! How Lenovo found treasure in the PC industry's trash, May 12: 46-51: (3) Y. Chen & M. Young, 2010, Cross-border M&As by Chinese listed companies, AsiaPacific Journal of Manage- ment 27: 523-539; (4) Economist 2012, The cat returns, September 29: 63; (5) S. Gubbi, P. Aulakh, S. Ray, M. Sarkar, & R. Chittoor, 2010, Do International acquisitions by emerging economy firms create shareholder value? Journal of Inter- national Business Studies, 41: 397-418; (6) 0. Hope, W. Thomas, & D. Vyas, 2011, The cost of pride, Journal of Intema- tional Business Studies, 42: 128-151; (7) S. Lahiri, B. Elango, & S. Kundu, 2014, Cross-border acquisition in services Journal of World Business, 49: 409-420; (8) S. Lebedev, M. W. Peng, E. Xie, & C. Stevens, 2015, Mergers and acquisi tions in and out of emerging economies, Journal of World Business (in press): (9) S. Sun, M. W. Penn B Rent