Question: Need some help solving this problem. AAPL AMD ORCL AAPL AMD ORCL Date Adj. Close* Adj. Close* Adj. Close* Return Return Return 2-Jan-97 6.91 17.57

Need some help solving this problem.

| AAPL | AMD | ORCL | AAPL | AMD | ORCL | |

| Date | Adj. Close* | Adj. Close* | Adj. Close* | Return | Return | Return |

| 2-Jan-97 | 6.91 | 17.57 | 4.32 | -0.5075 | -0.5537 | -0.1074 |

| 2-Jan-98 | 4.16 | 10.1 | 3.88 | 0.0962 | 0.1272 | 0.8666 |

| 4-Jan-99 | 4.58 | 11.47 | 9.23 | 0.8104 | 0.4506 | 0.9956 |

| 3-Jan-00 | 10.3 | 18 | 24.98 | 0.9236 | 0.3124 | 0.1533 |

| 2-Jan-01 | 25.94 | 24.6 | 29.12 | -0.8753 | -0.4270 | -0.5230 |

| 2-Jan-02 | 10.81 | 16.05 | 17.26 | 0.1340 | -1.1194 | -0.3610 |

| 2-Jan-03 | 12.36 | 5.24 | 12.03 | -0.5432 | 1.0424 | 0.1416 |

| 2-Jan-04 | 7.18 | 14.86 | 13.86 | 0.4517 | 0.0613 | -0.0065 |

| 3-Jan-05 | 11.28 | 15.8 | 13.77 | 1.2263 | 0.9729 | -0.0912 |

| 3-Jan-06 | 38.45 | 41.8 | 12.57 |

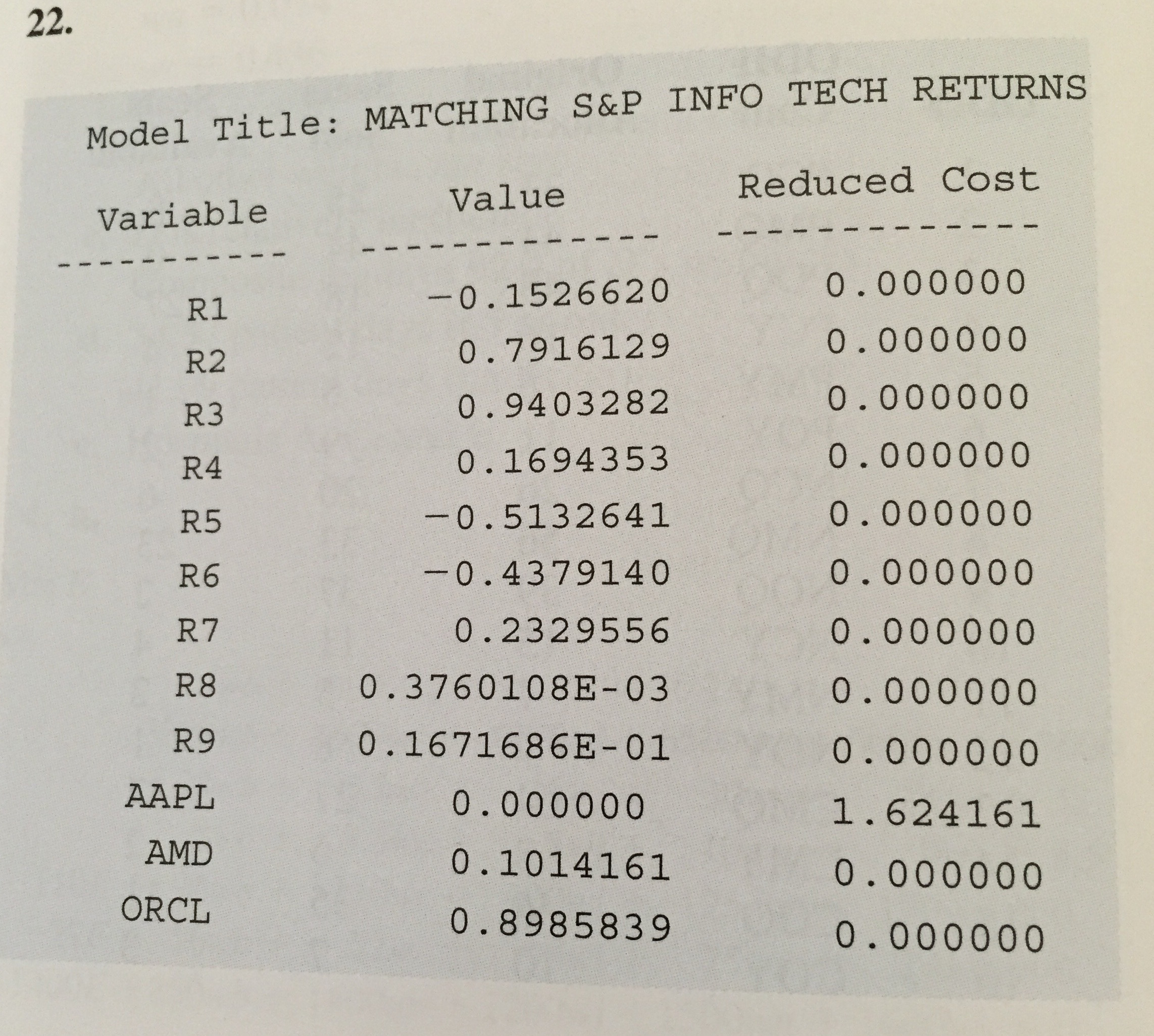

These are the answers from the book:

Not sure how to solve it.

22. Using the return data in Table 12.10, construct a portfolio from Apple, AMD, and Oracle that matches the Information Technology S&P index as closely as possible. Use the return data for the Information Technology S&P index given in the following table. The model for constructing the portfolio should be similar to the one developed for Hauck Financial Services in Section 12.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts