Question: need year 1 & year 2 answers please Homework: Chapter 10. Learning Objective 2. Topic Homework Save Score: 0.13 of 1 pt 7 of 9

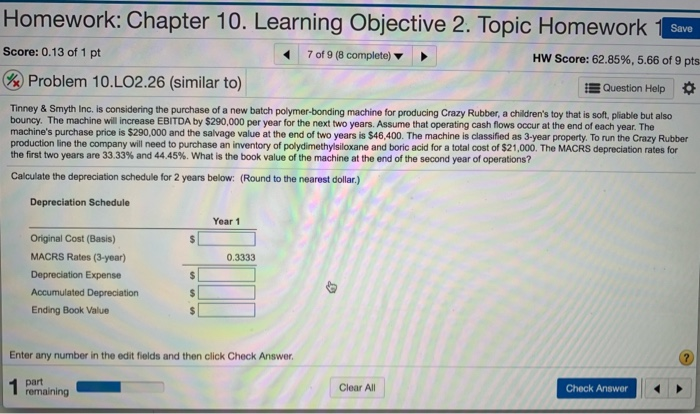

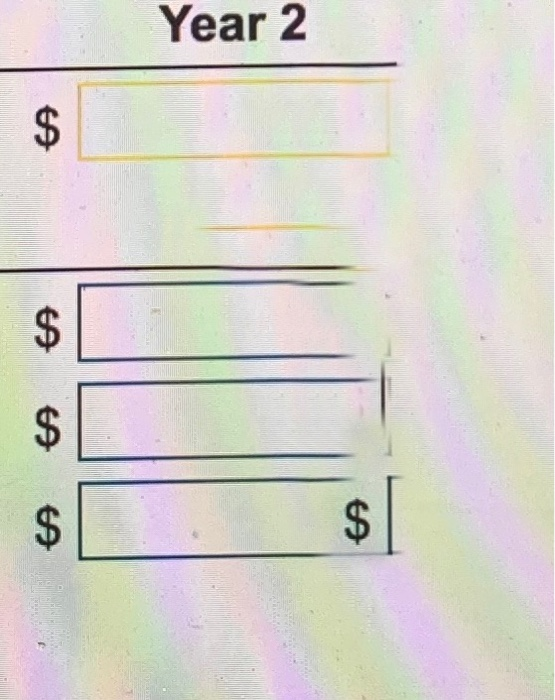

Homework: Chapter 10. Learning Objective 2. Topic Homework Save Score: 0.13 of 1 pt 7 of 9 (8 complete) HW Score: 62.85%, 5.66 of 9 pts Problem 10.LO2.26 (similar to) E Question Help Tinney & Smyth Inc. is considering the purchase of a new batch polymer-bonding machine for producing Crazy Rubber, a children's toy that is soft, pliable but also bouncy. The machine will increase EBITDA by $290,000 per year for the next two years. Assume that operating cash flows occur at the end of each year. The machine's purchase price is $290,000 and the salvage value at the end of two years is $46,400. The machine is classified as 3-year property. To run the Crazy Rubber production line the company will need to purchase an inventory of polydimethylsiloxane and boric acid for a total cost of $21,000. The MACRS depreciation rates for the first two years are 33.33% and 44.45%. What is the book value of the machine at the end of the second year of operations? Calculate the depreciation schedule for 2 years below: (Round to the nearest dollar.) Depreciation Schedule Year 1 Original Cost (Basis) MACRS Rates (3-year) Depreciation Expense Accumulated Depreciation Ending Book Value Enter any number in the edit fields and then click Check Answer part Clear Check Answer remaining Year 2 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts