Question: Net Present Value A project has estimated annual net cash flows of $8,750 for one years and is estimated to cost $40,000. Assume a minimum

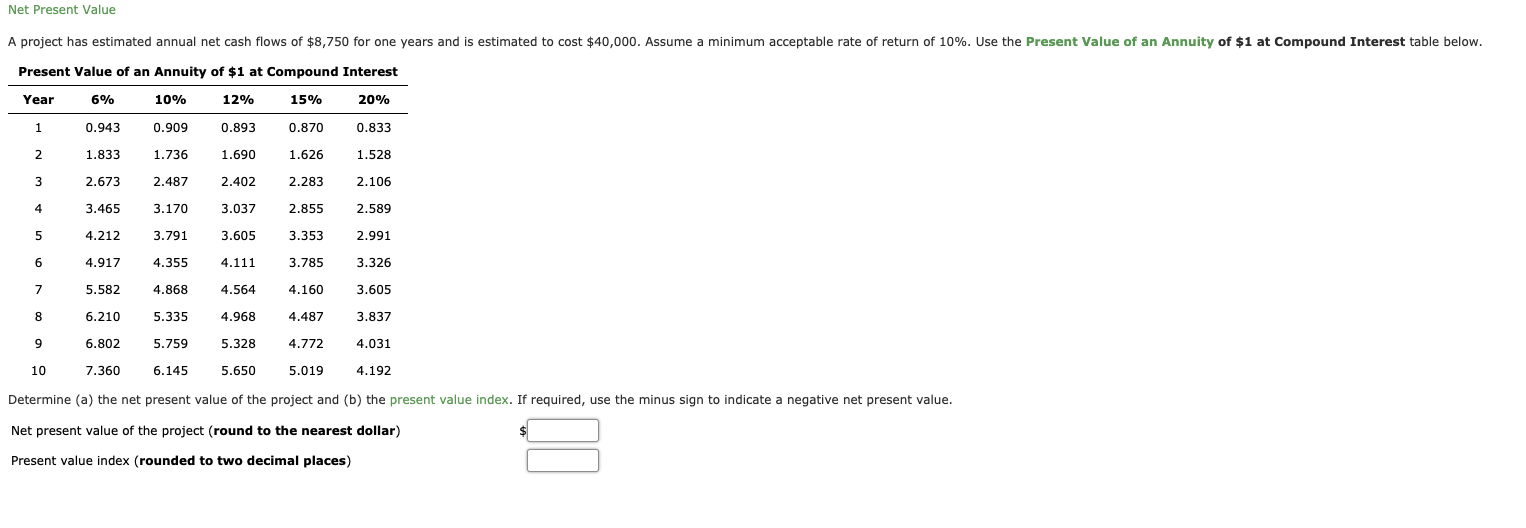

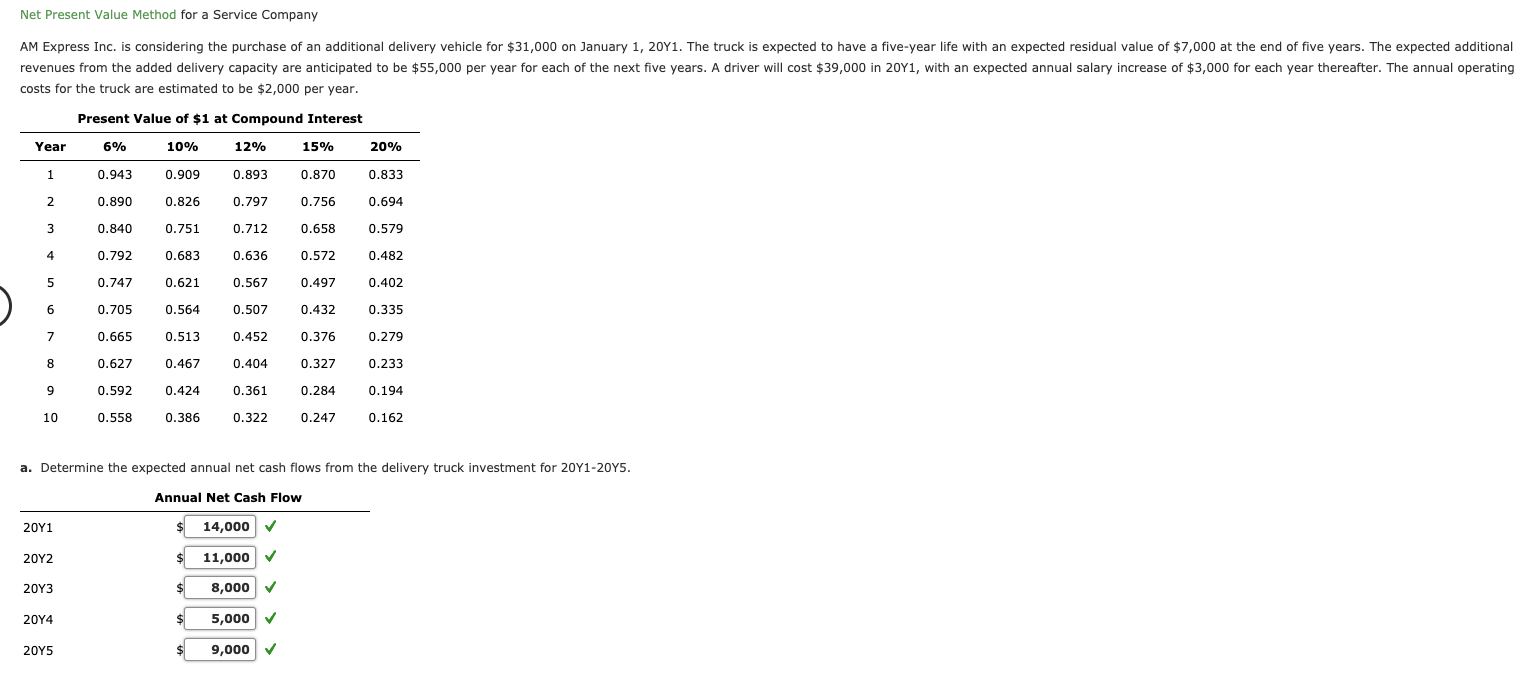

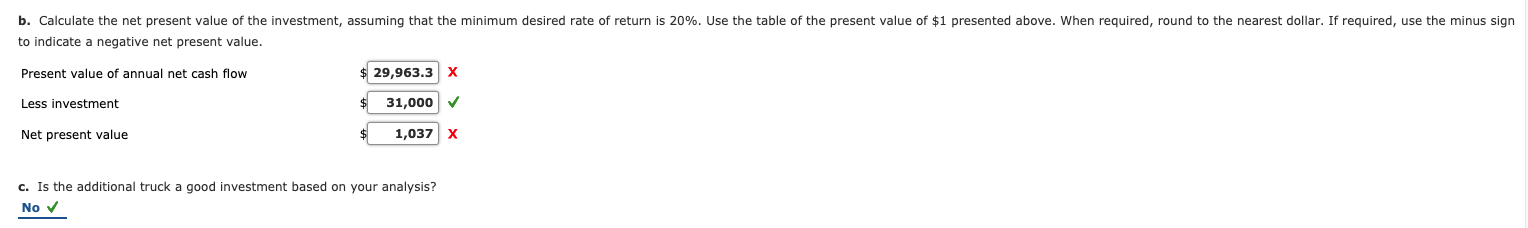

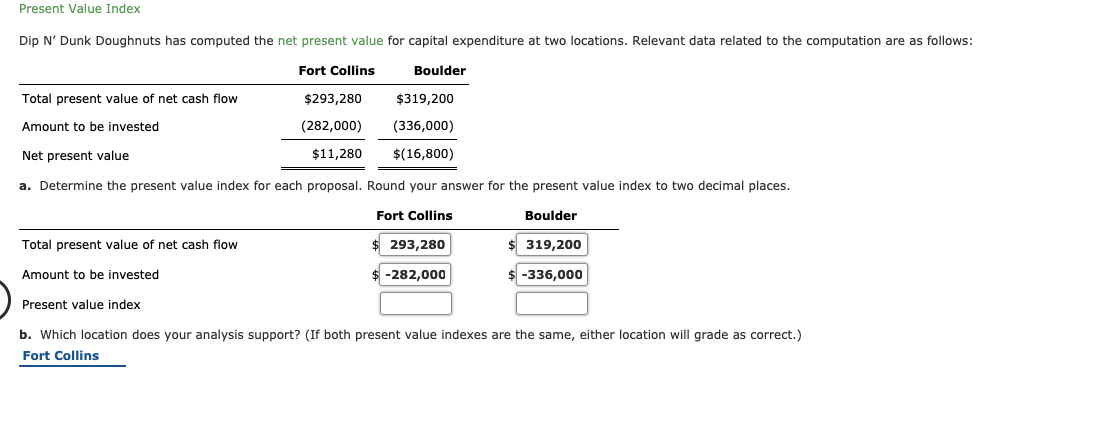

Net Present Value A project has estimated annual net cash flows of $8,750 for one years and is estimated to cost $40,000. Assume a minimum acceptable rate of return of 10%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (a) the net present value of the project and (b) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) 10 Present value index (rounded to two decimal places) Net Present Value Method for a Service Company AM Express Inc. is considering the purchase of an additional delivery vehicle for $31,000 on January 1, 20Y1. The truck is expected to have a five-year life with an expected residual value of $7,000 at the end of five years. The expected additional revenues from the added delivery capacity are anticipated to be $55,000 per year for each of the next five years. A driver will cost $39,000 in 20Y1, with an expected annual salary increase of $3,000 for each year thereafter. The annual operating costs for the truck are estimated to be $2,000 per year. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Determine the expected annual net cash flows from the delivery truck investment for 20Y1-20Y5. Annual Net Cash Flow 20Y1 14,000 20Y2 $ 11,000 20Y3 8,000 2014 $ 5,000 2045 $ 9,000 b. Calculate the net present value of the investment, assuming that the minimum desired rate of return is 20%. Use the table of the present value of $1 presented above. When required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flow $ 29,963.3 X Less investment $ 31,000 Net present value 1,037 X c. Is the additional truck a good investment based on your analysis? No Present Value Index Dip N' Dunk Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: Fort Collins Boulder Total present value of net cash flow $293,280 $319,200 Amount to be invested (282,000) (336,000) Net present value $11,280 $(16,800) a. Determine the present value index for each proposal. Round your answer for the present value index to two decimal places. Fort Collins Boulder Total present value of net cash flow 293,280 $319,200 Amount to be invested $ -282,000 -336,000 Present value index b. Which location does your analysis support? (If both present value indexes are the same, either location will grade as correct.) Fort Collins

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts