Question: Normal No Spacing Heading 1 Heading 2 Heading 2 Title Tele 21 .3 .4 .5 .6 . 7 1. Sophia and Jacob are married and

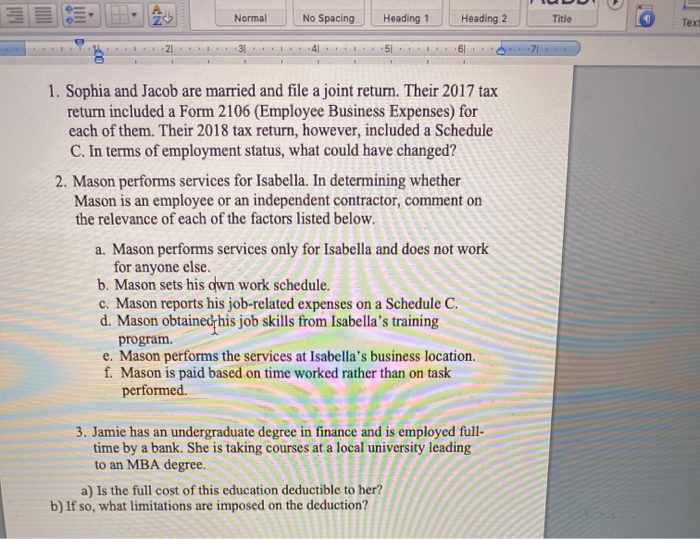

Normal No Spacing Heading 1 Heading 2 Heading 2 Title Tele 21 .3 .4 .5 .6 . 7 1. Sophia and Jacob are married and file a joint return. Their 2017 tax return included a Form 2106 (Employee Business Expenses) for each of them. Their 2018 tax return, however, included a Schedule C. In terms of employment status, what could have changed? 2. Mason performs services for Isabella. In determining whether Mason is an employee or an independent contractor, comment on the relevance of each of the factors listed below. a. Mason performs services only for Isabella and does not work for anyone else. b. Mason sets his own work schedule. c. Mason reports his job-related expenses on a Schedule C. d. Mason obtainedyhis job skills from Isabella's training program. e. Mason performs the services at Isabella's business location. f. Mason is paid based on time worked rather than on task performed 3. Jamie has an undergraduate degree in finance and is employed full- time by a bank. She is taking courses at a local university leading to an MBA degree. a) Is the full cost of this education deductible to her? b) If so, what limitations are imposed on the deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts