Question: Note: in all of these problems, start with the value of your underlying asset, and build your binomial trees as we always have before: U=

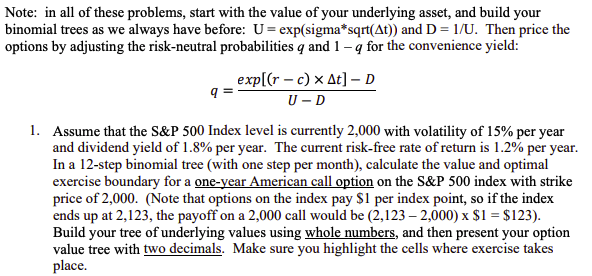

Note: in all of these problems, start with the value of your underlying asset, and build your binomial trees as we always have before: U= exp(sigma*sqrt(At)) and D=1/U. Then price the options by adjusting the risk-neutral probabilities q and 1 9 for the convenience yield: exp[(r - c) * At] - D 9 U-D 1. Assume that the S&P 500 Index level is currently 2,000 with volatility of 15% per year and dividend yield of 1.8% per year. The current risk-free rate of return is 1.2% per year. In a 12-step binomial tree (with one step per month), calculate the value and optimal exercise boundary for a one-year American call option on the S&P 500 index with strike price of 2,000. (Note that options on the index pay $1 per index point, so if the index ends up at 2,123, the payoff on a 2,000 call would be (2,123 2,000) x $1 = $123). Build your tree of underlying values using whole numbers, and then present your option value tree with two decimals. Make sure you highlight the cells where exercise takes place. Note: in all of these problems, start with the value of your underlying asset, and build your binomial trees as we always have before: U= exp(sigma*sqrt(At)) and D=1/U. Then price the options by adjusting the risk-neutral probabilities q and 1 9 for the convenience yield: exp[(r - c) * At] - D 9 U-D 1. Assume that the S&P 500 Index level is currently 2,000 with volatility of 15% per year and dividend yield of 1.8% per year. The current risk-free rate of return is 1.2% per year. In a 12-step binomial tree (with one step per month), calculate the value and optimal exercise boundary for a one-year American call option on the S&P 500 index with strike price of 2,000. (Note that options on the index pay $1 per index point, so if the index ends up at 2,123, the payoff on a 2,000 call would be (2,123 2,000) x $1 = $123). Build your tree of underlying values using whole numbers, and then present your option value tree with two decimals. Make sure you highlight the cells where exercise takes place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts