Question: Note: in all of these problems, start with the value of your underlying asset, and build your binomial trees as we always have before: U=

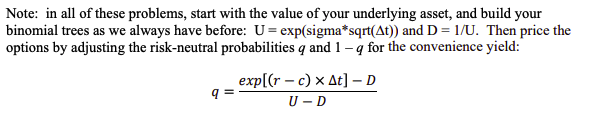

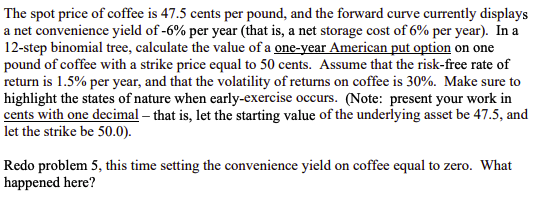

Note: in all of these problems, start with the value of your underlying asset, and build your binomial trees as we always have before: U= exp(sigma*sqrt(At)) and D= 1/U. Then price the options by adjusting the risk-neutral probabilities q and 1 q for the convenience yield: exp[(r - c) * At] - D q= U-D The spot price of coffee is 47.5 cents per pound, and the forward curve currently displays a net convenience yield of -6% per year (that is, a net storage cost of 6% per year). In a 12-step binomial tree, calculate the value of a one-year American put option on one pound of coffee with a strike price equal to 50 cents. Assume that the risk-free rate of return is 1.5% per year, and that the volatility of returns on coffee is 30%. Make sure to highlight the states of nature when early-exercise occurs. (Note: present your work in cents with one decimal that is, let the starting value of the underlying asset be 47.5, and let the strike be 50.0). Redo problem 5, this time setting the convenience yield on coffee equal to zero. What happened here? Note: in all of these problems, start with the value of your underlying asset, and build your binomial trees as we always have before: U= exp(sigma*sqrt(At)) and D= 1/U. Then price the options by adjusting the risk-neutral probabilities q and 1 q for the convenience yield: exp[(r - c) * At] - D q= U-D The spot price of coffee is 47.5 cents per pound, and the forward curve currently displays a net convenience yield of -6% per year (that is, a net storage cost of 6% per year). In a 12-step binomial tree, calculate the value of a one-year American put option on one pound of coffee with a strike price equal to 50 cents. Assume that the risk-free rate of return is 1.5% per year, and that the volatility of returns on coffee is 30%. Make sure to highlight the states of nature when early-exercise occurs. (Note: present your work in cents with one decimal that is, let the starting value of the underlying asset be 47.5, and let the strike be 50.0). Redo problem 5, this time setting the convenience yield on coffee equal to zero. What happened here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts