Question: notes: I hope the answer can be fully complete and clear BOBS had just graduated and returned home after few years study abroad. He is

notes: I hope the answer can be fully complete and clear

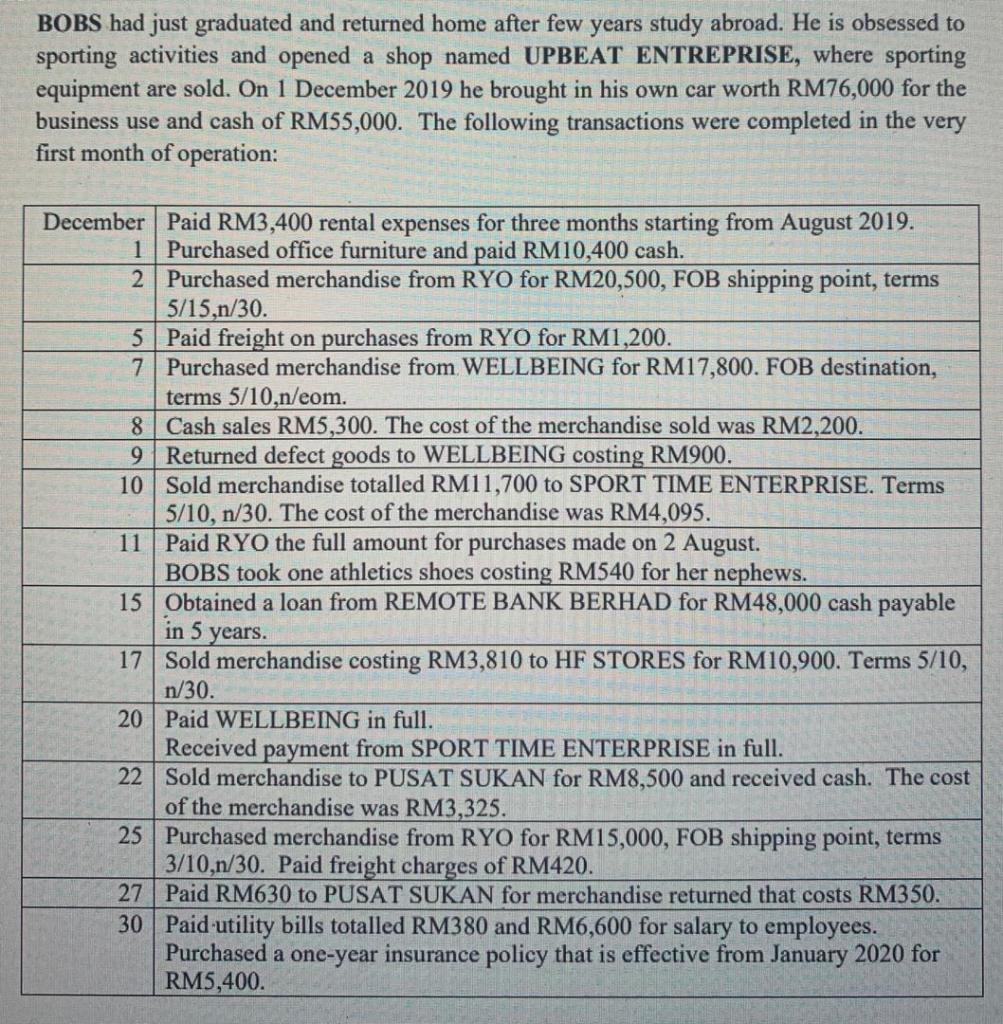

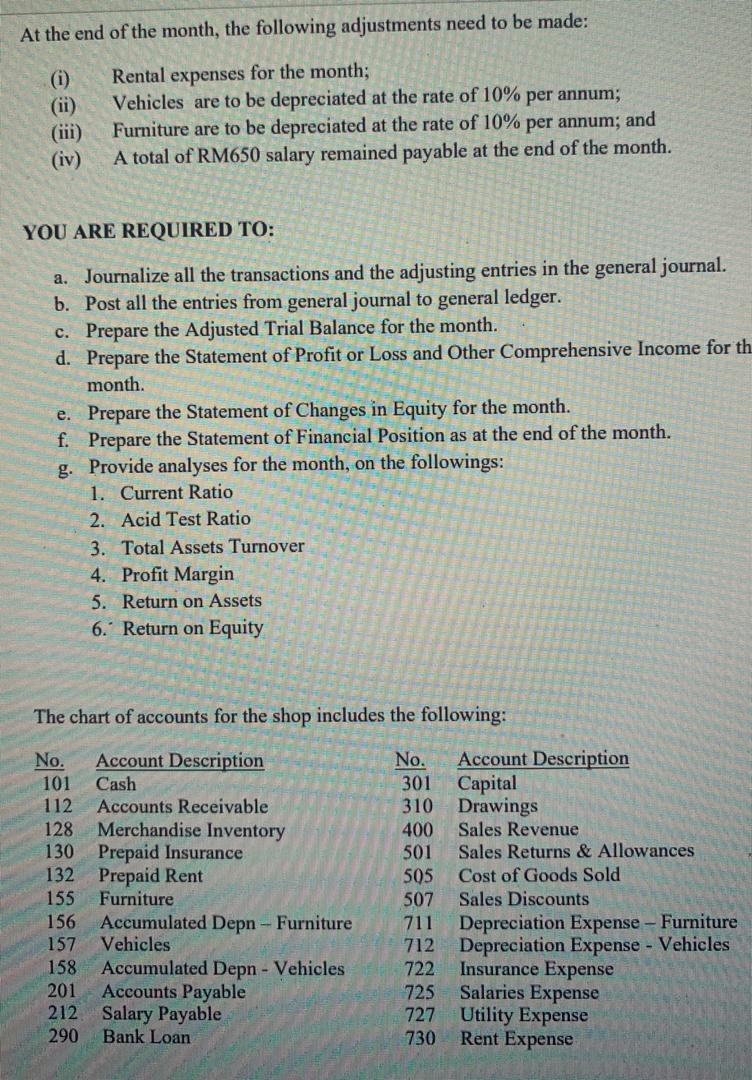

BOBS had just graduated and returned home after few years study abroad. He is obsessed to sporting activities and opened a shop named UPBEAT ENTREPRISE, where sporting equipment are sold. On 1 December 2019 he brought in his own car worth RM76,000 for the business use and cash of RM55,000. The following transactions were completed in the very first month of operation: December Paid RM3,400 rental expenses for three months starting from August 2019. 1 Purchased office furniture and paid RM10,400 cash. 2 Purchased merchandise from RYO for RM20,500, FOB shipping point, terms 5/15,n/30. 5 Paid freight on purchases from RYO for RM1,200. 7 Purchased merchandise from WELLBEING for RM17,800. FOB destination, terms 5/10,n/eom. 8 Cash sales RM5,300. The cost of the merchandise sold was RM2,200. 9 Returned defect goods to WELLBEING costing RM900. 10 Sold merchandise totalled RM11,700 to SPORT TIME ENTERPRISE. Terms 5/10, n/30. The cost of the merchandise was RM4,095. 11 Paid RYO the full amount for purchases made on 2 August. BOBS took one athletics shoes costing RM540 for her nephews. 15 Obtained a loan from REMOTE BANK BERHAD for RM48,000 cash payable in 5 years. 17 Sold merchandise costing RM3,810 to HF STORES for RM10,900. Terms 5/10, n/30. 20 Paid WELLBEING in full. Received payment from SPORT TIME ENTERPRISE in full. 22 Sold merchandise to PUSAT SUKAN for RM8,500 and received cash. The cost of the merchandise was RM3,325. 25 Purchased merchandise from RYO for RM15,000, FOB shipping point, terms 3/10,n/30. Paid freight charges of RM420. 27 Paid RM630 to PUSAT SUKAN for merchandise returned that costs RM350. 30 Paid utility bills totalled RM380 and RM6,600 for salary to employees. Purchased a one-year insurance policy that is effective from January 2020 for RM5,400. At the end of the month, the following adjustments need to be made: Rental expenses for the month; Vehicles are to be depreciated at the rate of 10% per annum; Furniture are to be depreciated at the rate of 10% per annum; and A total of RM650 salary remained payable at the end of the month. (iv) YOU ARE REQUIRED TO: a. Journalize all the transactions and the adjusting entries in the general journal. b. Post all the entries from general journal to general ledger. c. Prepare the Adjusted Trial Balance for the month. d. Prepare the Statement of Profit or Loss and Other Comprehensive Income for th month. e. Prepare the Statement of Changes in Equity for the month. f. Prepare the Statement of Financial Position as at the end of the month. g. Provide analyses for the month, on the followings: 1. Current Ratio 2. Acid Test Ratio 3. Total Assets Turnover 4. Profit Margin 5. Return on Assets 6. Return on Equity The chart of accounts for the shop includes the following: 128 No. Account Description 101 Cash 112 Accounts Receivable Merchandise Inventory 130 Prepaid Insurance 132 Prepaid Rent 155 Furniture 156 Accumulated Depn -- Furniture 157 Vehicles 158 Accumulated Depn - Vehicles 201 Accounts Payable 212 Salary Payable 290 Bank Loan No. Account Description 301 Capital 310 Drawings 400 Sales Revenue 501 Sales Returns & Allowances 505 Cost of Goods Sold 507 Sales Discounts 711 Depreciation Expense - Furniture 712 Depreciation Expense - Vehicles 722 Insurance Expense 725 Salaries Expense 727 Utility Expense 730 Rent Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts