Question: Number File Edit Insert Table Organize Format Arrange 121026 View Share Windo ao 2020 Edited 126 Zoom + Q3 94 95 Q5 There is not

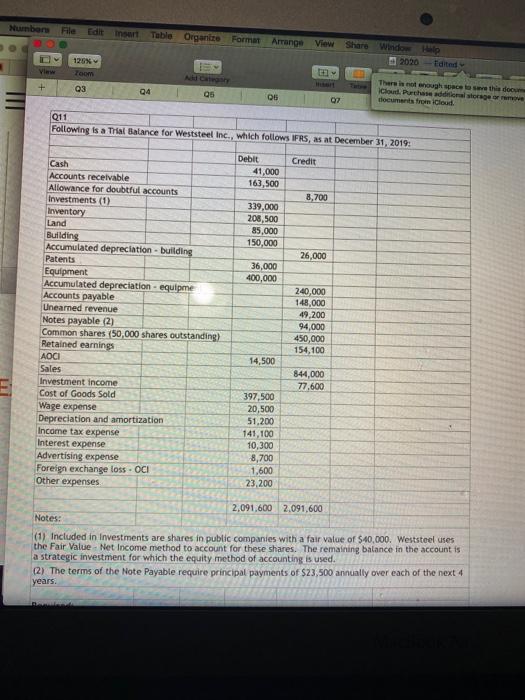

Number File Edit Insert Table Organize Format Arrange 121026 View Share Windo ao 2020 Edited 126 Zoom + Q3 94 95 Q5 There is not enough space to see the door Cod Purchase additionale tlocuments from iCloud 07 011 Following is a Thal Balance for Weststeel Inc., which follows IFRS, as at December 31, 2019: Credit Debit 41,000 163,500 8,700 339.000 208,500 85,000 150,000 26,000 36,000 400,000 Cash Accounts receivable Allowance for doubtful accounts Investments (1) Inventory Land Building Accumulated depreciation - building Patents Equipment Accumulated depreciation equipme Accounts payable Unearned revenue Notes payable (2) Common shares 50,000 shares outstanding) Retained earnings AOCI Sales Investment income Cost of Goods Sold Wage expense Depreciation and amortization Income tax expense Interest expense Advertising expense Foreign exchange loss. OCI Other expenses 240,000 148.000 49,200 94,000 450,000 154,100 14,500 844,000 77,600 397,500 20,500 51,200 141,100 10,300 8,700 1,600 23,200 2,091,600 2,091,600 Notes: (1) Included in Investments are shares in public companies with a fair value of $40,000. Weststoel uses the Fair Value - Net Income method to account for these shares. The remaining balance in the account is a strategic investment for which the equity method of accounting is used. (2) The terms of the Note Payable require principal payments of $23,500 annually over each of the next 4 years. aber File Edit Insert Table Organize Format Arrange View Share Window Help 2020 Edited ul Chart Trect T Add Category Table Media 125% View Zoom + Q3 04 TUEELTOnge wa Other expenses Q5 OZ QB 09 Q6 TO 23,200 2,091,600 2,091,600 Notes: (1) Included in Investments are shares in public companies with a fair value of $40,000. Weststeel uses the Fair Value - Net Income method to account for these shares. The remaining balance in the account is a strategic investment for which the equity method of accounting is used. (2) The terms of the Note Payable require principal payments of $23,500 annually over each of the next 4 years. Required: (a) Prepare a statement of Income and comprehensive Income for the year ended December 31, 2019 (11 m (b)Prepare a classified Statement of Financial Position as at December 31, 2019. (14 marks) (c) Calculate the following ratios. Show all work (6 marks): (i) Current ratio (ii) Quick ratio (ii) Debt to total assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts