Question: Old MathJax webview Old MathJax webview please solve the table below asap and show all formulas used please complete all tables e and can be

Old MathJax webview

please solve the table below asap and show all formulas used

please complete all tables

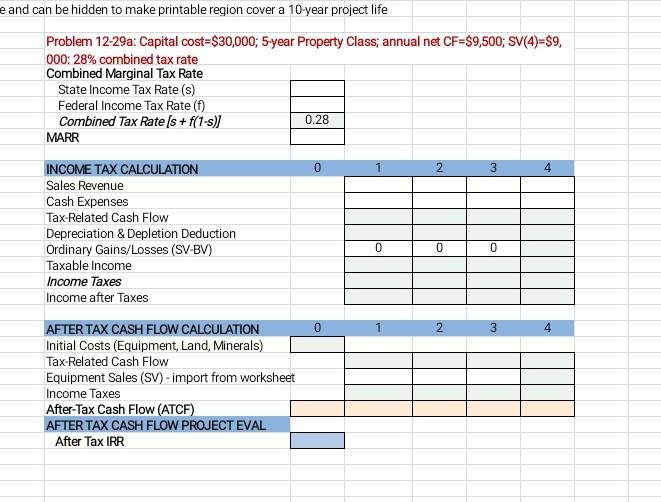

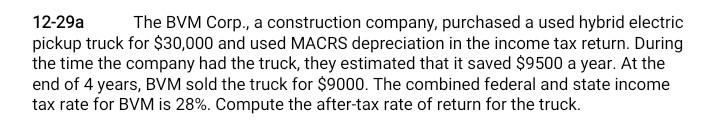

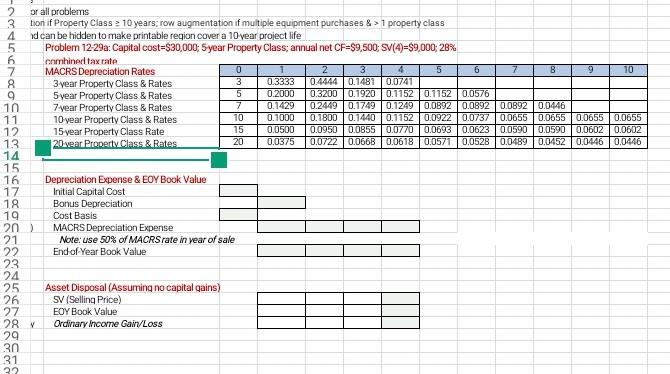

e and can be hidden to make printable region cover a 10-year project life 0 Problem 12-29a: Capital cost=$30,000; 5-year Property Class; annual net CF=$9,500; SV(4)=$9, 000: 28% combined tax rate Combined Marginal Tax Rate State Income Tax Rate (s) Federal Income Tax Rate (f) Combined Tax Rate /s + f(1-s) 0.28 MARR INCOME TAX CALCULATION 1 2 3 4 Sales Revenue Cash Expenses Tax Related Cash Flow Depreciation & Depletion Deduction Ordinary Gains/Losses (SV-BV) 0 Taxable income Income Taxes Income after Taxes 3 0 0 0 N 2 00 3 4 AFTER TAX CASH FLOW CALCULATION Initial Costs (Equipment, Land, Minerals) Tax-Related Cash Flow Equipment Sales (SV) - import from worksheet Income Taxes After-Tax Cash Flow (ATCF) AFTER TAX CASH FLOW PROJECT EVAL After Tax IRR 12-29a The BVM Corp., a construction company, purchased a used hybrid electric pickup truck for $30,000 and used MACRS depreciation in the income tax return. During the time the company had the truck, they estimated that it saved $9500 a year. At the end of 4 years, BVM sold the truck for $9000. The combined federal and state income tax rate for BVM is 28%. Compute the after-tax rate of return for the truck. -NOS 10 0.0655 0.0602 0.0446 2 or all problems tion if Property Class 2 10 years; row augmentation if multiple equipment purchases &> 1 property class nd can be hidden to make printable region cover a 10 year project life 5 Problem 12-29a: Capital cost=$30,000; 5 year Property Class; annual net CF=$9,500; SV(4)=$9,000; 28% 6 combined tax rate 7 MACRS Depreciation Rates 0 2 3 4 5 6 7 9 8 3 year Property Class & Rates 3 0.3333 0.4444 0.1481 0.0741 9 5 year Property Class & Rates 5 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 10 7-year Property Class & Rates 7 0.1429 0.2449 0.1749 0.1249 0.0892 0.0892 0.0892 0.0446 11 10 year Property Class & Rates 10 0.1000 0.18000.1440 0.1152 0.0922 0.0737 0.0655 0.0655 0.0655 12 15 year Property Class Rate 15 0.0500 0.0950 0.0855 0.0770 | 0.0693 0.0623 0.0590 0.0590 0.0602 13 20 year Property Class & Rates 20 0.0375 0.0722 0.066B 0.0618 0.0571 0.0528 0.0489 0.0452 0.0446 14 15 16 Depreciation Expense & EOY Book Value 17 Initial Capital Cost 18 Bonus Depreciation 19 Cost Basis 20) MACRS Depreciation Expense 21 Note: use 50% of MACRS rate in year of sale 22 End of Year Book Value 23 24 25 Asset Disposal (Assuming no capital gains) 26 SV (Selling Price) 27 EOY Book Value 28 Ordinary Income Gain/Loss 29 30 31 32 Anewel sale of Current value of truck $30,000 truck 219,000 (+) Saving from trudle = $9500 (4) = $39,000 Total = $47,000. Povestement increases : $12,000 which is (47,000 30,000) combined tax $287. (17,000) $478. After tax income a 17,000 -4760 $12,240. Nole :- Rate of Return is the percentage increase or decrease of an investement over a set period of time 14 years) which is calculated by by talking the difference between the curent value and original value, dividing by the original value then it is multiplied by 100. \ e and can be hidden to make printable region cover a 10-year project life 0 Problem 12-29a: Capital cost=$30,000; 5-year Property Class; annual net CF=$9,500; SV(4)=$9, 000: 28% combined tax rate Combined Marginal Tax Rate State Income Tax Rate (s) Federal Income Tax Rate (f) Combined Tax Rate /s + f(1-s) 0.28 MARR INCOME TAX CALCULATION 1 2 3 4 Sales Revenue Cash Expenses Tax Related Cash Flow Depreciation & Depletion Deduction Ordinary Gains/Losses (SV-BV) 0 Taxable income Income Taxes Income after Taxes 3 0 0 0 N 2 00 3 4 AFTER TAX CASH FLOW CALCULATION Initial Costs (Equipment, Land, Minerals) Tax-Related Cash Flow Equipment Sales (SV) - import from worksheet Income Taxes After-Tax Cash Flow (ATCF) AFTER TAX CASH FLOW PROJECT EVAL After Tax IRR 12-29a The BVM Corp., a construction company, purchased a used hybrid electric pickup truck for $30,000 and used MACRS depreciation in the income tax return. During the time the company had the truck, they estimated that it saved $9500 a year. At the end of 4 years, BVM sold the truck for $9000. The combined federal and state income tax rate for BVM is 28%. Compute the after-tax rate of return for the truck. -NOS 10 0.0655 0.0602 0.0446 2 or all problems tion if Property Class 2 10 years; row augmentation if multiple equipment purchases &> 1 property class nd can be hidden to make printable region cover a 10 year project life 5 Problem 12-29a: Capital cost=$30,000; 5 year Property Class; annual net CF=$9,500; SV(4)=$9,000; 28% 6 combined tax rate 7 MACRS Depreciation Rates 0 2 3 4 5 6 7 9 8 3 year Property Class & Rates 3 0.3333 0.4444 0.1481 0.0741 9 5 year Property Class & Rates 5 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 10 7-year Property Class & Rates 7 0.1429 0.2449 0.1749 0.1249 0.0892 0.0892 0.0892 0.0446 11 10 year Property Class & Rates 10 0.1000 0.18000.1440 0.1152 0.0922 0.0737 0.0655 0.0655 0.0655 12 15 year Property Class Rate 15 0.0500 0.0950 0.0855 0.0770 | 0.0693 0.0623 0.0590 0.0590 0.0602 13 20 year Property Class & Rates 20 0.0375 0.0722 0.066B 0.0618 0.0571 0.0528 0.0489 0.0452 0.0446 14 15 16 Depreciation Expense & EOY Book Value 17 Initial Capital Cost 18 Bonus Depreciation 19 Cost Basis 20) MACRS Depreciation Expense 21 Note: use 50% of MACRS rate in year of sale 22 End of Year Book Value 23 24 25 Asset Disposal (Assuming no capital gains) 26 SV (Selling Price) 27 EOY Book Value 28 Ordinary Income Gain/Loss 29 30 31 32 Anewel sale of Current value of truck $30,000 truck 219,000 (+) Saving from trudle = $9500 (4) = $39,000 Total = $47,000. Povestement increases : $12,000 which is (47,000 30,000) combined tax $287. (17,000) $478. After tax income a 17,000 -4760 $12,240. Nole :- Rate of Return is the percentage increase or decrease of an investement over a set period of time 14 years) which is calculated by by talking the difference between the curent value and original value, dividing by the original value then it is multiplied by 100. \

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts