Question: Old MathJax webview please do it in 20 minutes will upvote 150 10. Answer both parts of this question. (a) A long butterfly spread with

Old MathJax webview

please do it in 20 minutes will upvote

150

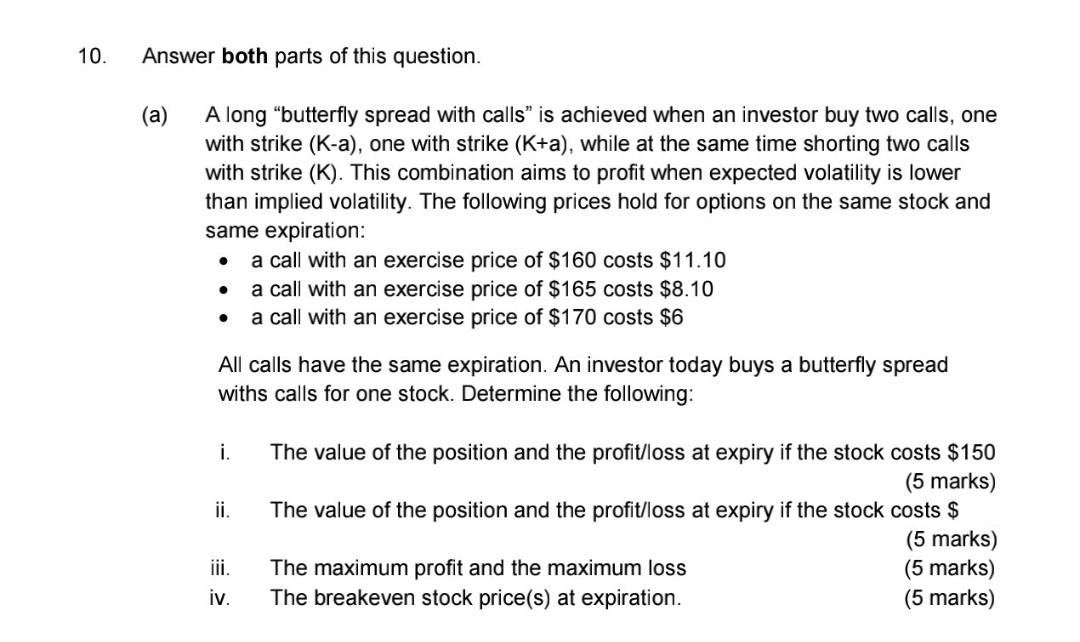

10. Answer both parts of this question. (a) A long "butterfly spread with calls" is achieved when an investor buy two calls, one with strike (K-a), one with strike (K+a), while at the same time shorting two calls with strike (K). This combination aims to profit when expected volatility is lower than implied volatility. The following prices hold for options on the same stock and same expiration: a call with an exercise price of $160 costs $11.10 a call with an exercise price of $165 costs $8.10 a call with an exercise price of $170 costs $6 All calls have the same expiration. An investor today buys a butterfly spread withs calls for one stock. Determine the following: i. The value of the position and the profit/loss at expiry if the stock costs $150 (5 marks) ii. The value of the position and the profit/loss at expiry if the stock costs $ (5 marks) iii. The maximum profit and the maximum loss (5 marks) iv. The breakeven stock price(s) at expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts