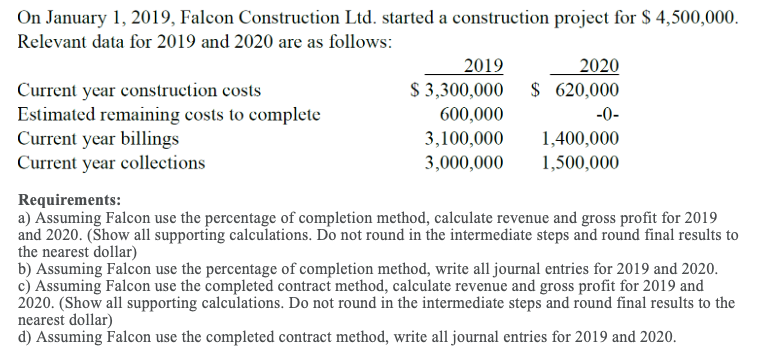

Question: On January 1, 2019, Falcon Construction Ltd. started a construction project for $ 4,500,000. Relevant data for 2019 and 2020 are as follows: 2019 2020

On January 1, 2019, Falcon Construction Ltd. started a construction project for $ 4,500,000. Relevant data for 2019 and 2020 are as follows: 2019 2020 Current year construction costs $ 3,300,000 $ 620,000 Estimated remaining costs to complete 600,000 -0- Current year billings 3,100,000 1,400,000 Current year collections 3,000,000 1,500,000 Requirements: a) Assuming Falcon use the percentage of completion method, calculate revenue and gross profit for 2019 and 2020. (Show all supporting calculations. Do not round in the intermediate steps and round final results to the nearest dollar) b) Assuming Falcon use the percentage of completion method, write all journal entries for 2019 and 2020. c) Assuming Falcon use the completed contract method, calculate revenue and gross profit for 2019 and 2020. (Show all supporting calculations. Do not round in the intermediate steps and round final results to the nearest dollar) d) Assuming Falcon use the completed contract method, write all journal entries for 2019 and 2020. On January 1, 2019, Falcon Construction Ltd. started a construction project for $ 4,500,000. Relevant data for 2019 and 2020 are as follows: 2019 2020 Current year construction costs $ 3,300,000 $ 620,000 Estimated remaining costs to complete 600,000 -0- Current year billings 3,100,000 1,400,000 Current year collections 3,000,000 1,500,000 Requirements: a) Assuming Falcon use the percentage of completion method, calculate revenue and gross profit for 2019 and 2020. (Show all supporting calculations. Do not round in the intermediate steps and round final results to the nearest dollar) b) Assuming Falcon use the percentage of completion method, write all journal entries for 2019 and 2020. c) Assuming Falcon use the completed contract method, calculate revenue and gross profit for 2019 and 2020. (Show all supporting calculations. Do not round in the intermediate steps and round final results to the nearest dollar) d) Assuming Falcon use the completed contract method, write all journal entries for 2019 and 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts