Question: In January 2016, Lufthansa, a German airline, purchased twenty 737 jets from the American company. Boeing for a total cost of USD 500 million

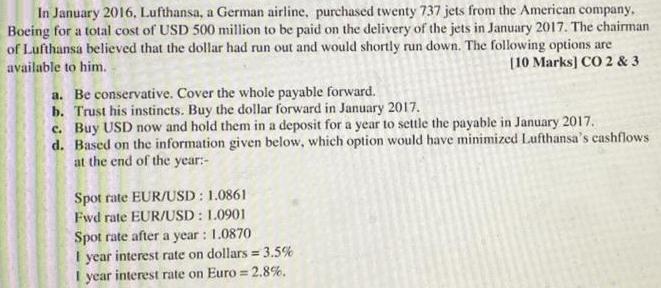

In January 2016, Lufthansa, a German airline, purchased twenty 737 jets from the American company. Boeing for a total cost of USD 500 million to be paid on the delivery of the jets in January 2017. The chairman of Lufthansa believed that the dollar had run out and would shortly run down. The following options are available to him. [10 Marks] CO 2 & 3 a. Be conservative. Cover the whole payable forward. b. Trust his instincts. Buy the dollar forward in January 2017. e. Buy USD now and hold them in a deposit for a year to settle the payable in January 2017. d. Based on the information given below, which option would have minimized Lufthansa's cashflows at the end of the year:- Spot rate EUR/USD: 1.0861 Fwd rate EUR/USD: 1.0901 Spot rate after a year: 1.0870 I year interest rate on dollars = 3.5% I year interest rate on Euro = 2.8%.

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

d Lufthansas Cashflow would be minimized when they Buy USD now and hel... View full answer

Get step-by-step solutions from verified subject matter experts