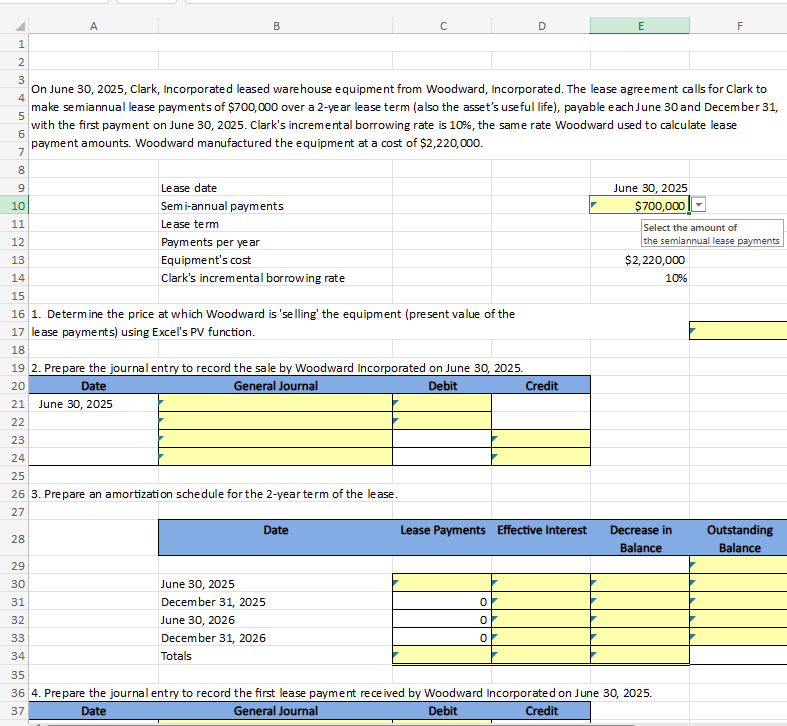

Question: On June 3 0 , 2 0 2 5 , Clark, Incorporated leased warehouse equipment from Woodward, Incorporated. The lease agreement calls for Clark to

On June Clark, Incorporated leased warehouse equipment from Woodward, Incorporated. The lease agreement calls for Clark to make semiannual lease payments of $ over a year lease term also the asset's useful life payable each June and December with the first payment on June Clark's incremental borrowing rate is the same rate Woodward used to calculate lease payment amounts. Woodward manufactured the equipment at a cost of $

Determine the price at which Woodward is se lling' the equipment present value of the lease payments using Excel's PV function.

Prepare the journal entry to record the sale by Woodward Incorporated on June

Prepare the journal entry to record the sale by Woodward Incorporated on June

Prepare an amortization schedule for the year term of the lease.

Prepare the journal entry to record the first lease payment received by Woodward Incorporated on June

Prepare the journal entry to record the second lease payment received by Woodward Incorporated on Decem ber

Indicate the amounts related to the lease reported on the yearend balance sheets and income statements. Ignore taxes PLEASE SHOW EXCEL FORMULAS USED

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock