Question: Only question A Consider again the ISEM Well Technology Company's manufacturing problem in Assignment 3. After some preliminary analysis, the company's engineers narrowed down its

Only question A

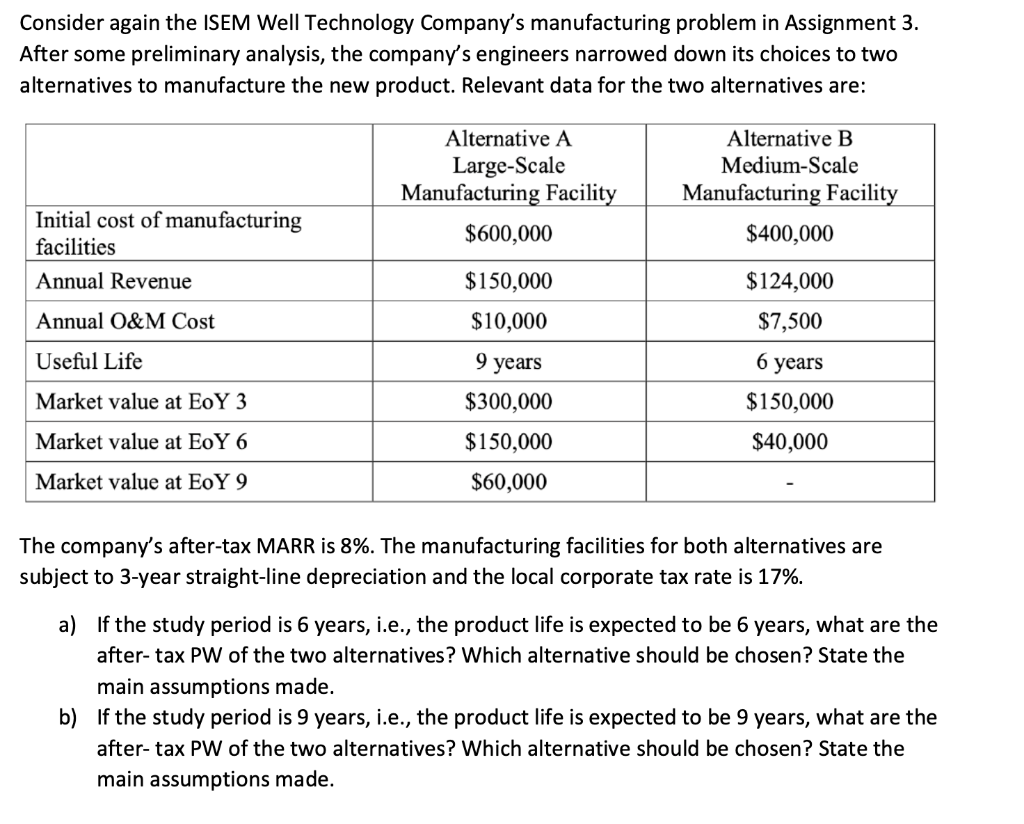

Consider again the ISEM Well Technology Company's manufacturing problem in Assignment 3. After some preliminary analysis, the company's engineers narrowed down its choices to two alternatives to manufacture the new product. Relevant data for the two alternatives are: The company's after-tax MARR is 8%. The manufacturing facilities for both alternatives are subject to 3 -year straight-line depreciation and the local corporate tax rate is 17%. a) If the study period is 6 years, i.e., the product life is expected to be 6 years, what are the after- tax PW of the two alternatives? Which alternative should be chosen? State the main assumptions made. b) If the study period is 9 years, i.e., the product life is expected to be 9 years, what are the after- tax PW of the two alternatives? Which alternative should be chosen? State the main assumptions made. Consider again the ISEM Well Technology Company's manufacturing problem in Assignment 3. After some preliminary analysis, the company's engineers narrowed down its choices to two alternatives to manufacture the new product. Relevant data for the two alternatives are: The company's after-tax MARR is 8%. The manufacturing facilities for both alternatives are subject to 3 -year straight-line depreciation and the local corporate tax rate is 17%. a) If the study period is 6 years, i.e., the product life is expected to be 6 years, what are the after- tax PW of the two alternatives? Which alternative should be chosen? State the main assumptions made. b) If the study period is 9 years, i.e., the product life is expected to be 9 years, what are the after- tax PW of the two alternatives? Which alternative should be chosen? State the main assumptions made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts