Question: ons Help Last edit was made seconds ago by Phisut Uiprasertwattana rial 11 v BI UA ini 111 2 QUESTION 13 Jill purchased her principal

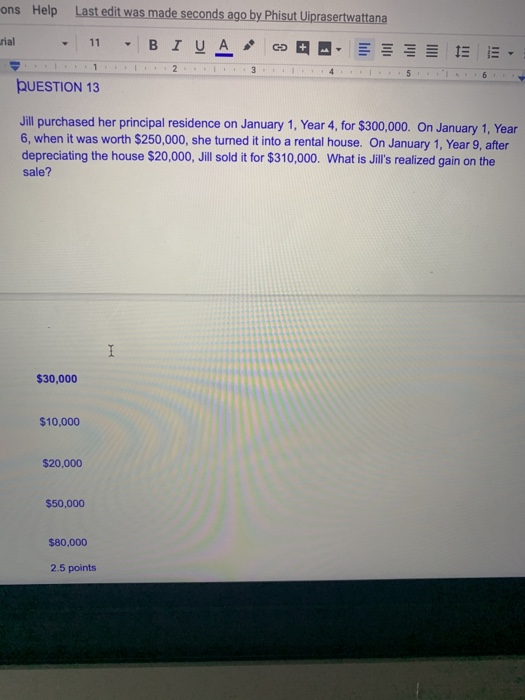

ons Help Last edit was made seconds ago by Phisut Uiprasertwattana rial 11 v BI UA ini 111 2 QUESTION 13 Jill purchased her principal residence on January 1, Year 4 for $300,000. On January 1, Year 6, when it was worth $250,000, she turned it into a rental house. On January 1, Year 9, after depreciating the house $20,000, Jill sold it for $310,000. What is Jill's realized gain on the sale? I $30,000 $10,000 $20.000 $50,000 $80,000 2.5 points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock