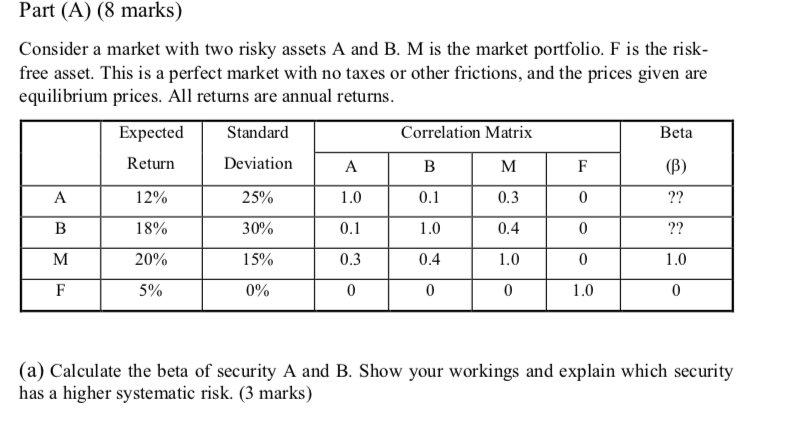

Question: Part (A) (8 marks) Consider a market with two risky assets A and B. M is the market portfolio. F is the risk- free asset.

Part (A) (8 marks) Consider a market with two risky assets A and B. M is the market portfolio. F is the risk- free asset. This is a perfect market with no taxes or other frictions, and the prices given are equilibrium prices. All returns are annual returns. Expected Standard Correlation Matrix Beta Return Deviation A B M F (6) A 12% 25% 1.0 0.1 0.3 0 ?? B 18% 30% 0.1 1.0 0.4 0 ?? M 20% 15% 0.3 0.4 1.0 0 1.0 F 5% 0% 0 0 0 1.0 0 (a) Calculate the beta of security A and B. Show your workings and explain which security has a higher systematic risk

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock