Question: Part II (3 marks) Project Fox and Project Tiger are mutually exclusive projects with conventional cash flows. The net present value (NPV) for each project

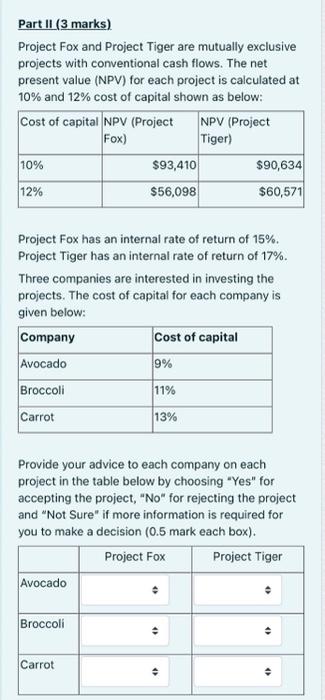

Part II (3 marks) Project Fox and Project Tiger are mutually exclusive projects with conventional cash flows. The net present value (NPV) for each project is calculated at 10% and 12% cost of capital shown as below: Cost of capital NPV (Project NPV (Project Fox) Tiger) $93,410 $90,634 12% $56,098 $60,571 10% Project Fox has an internal rate of return of 15%. Project Tiger has an internal rate of return of 17%. Three companies are interested in investing the projects. The cost of capital for each company is given below: Company Cost of capital Avocado 9% Broccoli 11% Carrot 13% Provide your advice to each company on each project in the table below by choosing "Yes" for accepting the project, "No" for rejecting the project and "Not Sure" if more information is required for you to make a decision (0.5 mark each box). Project Fox Project Tiger Avocado Broccoli Carrot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts