Question: question 11-12 are based on the information above! please solve both. thanks Answer questions #10 - #15 based on the following information. We have a

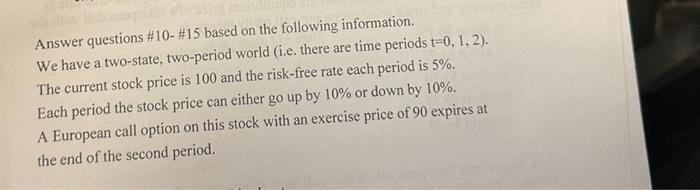

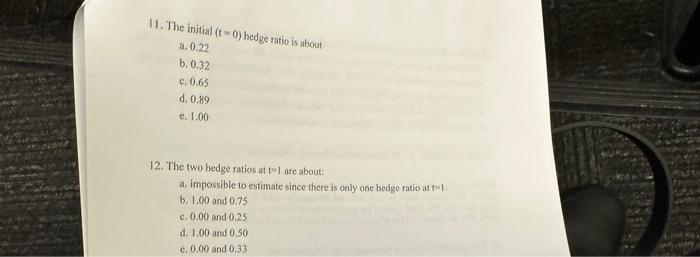

Answer questions #10 - \#15 based on the following information. We have a two-state, two-period world (i.e. there are time periods t=0,1,2 ). The current stock price is 100 and the risk-free rate each period is 5%. Each period the stock price can either go up by 10% or down by 10%. A European call option on this stock with an exercise price of 90 expires at the end of the second period. 11. The initial (t=0) hedge ratio is about a. 0.22 b. 0.32 c. 0.65 d. 0.89 e. 1.00 12. The two hedge ratios at twe are about: a. impossible to estimate since there is only one bedge ratio at t=1 b. 1.00 and 0.75 c. 0.00 and 0.25 d. 1.00 and 0.50 e. 0.00 and 0.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts