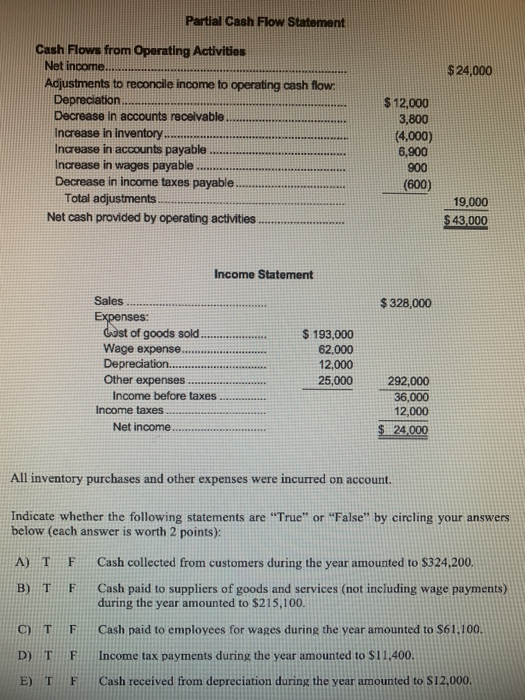

Question: Partial Cash Flow Statement $24,000 Cash Flows from Operating Activities Net income. Adjustments to reconcile income to operating cash flow Depreciation Decrease in accounts receivable

Partial Cash Flow Statement $24,000 Cash Flows from Operating Activities Net income. Adjustments to reconcile income to operating cash flow Depreciation Decrease in accounts receivable Increase in inventory. Increase in accounts payable Increase in wages payable Decrease in income taxes payable Total adjustments Net cash provided by operating activities $ 12,000 3,800 (4,000) 6,900 900 (600) 19.000 $ 43,000 Income Statement $ 328,000 Sales Expenses: Gost of goods sold Wage expense Depreciation.. Other expenses Income before taxes Income taxes Net income $ 193,000 62.000 12,000 25,000 292,000 36,000 12,000 $ 24,000 All inventory purchases and other expenses were incurred on account. Indicate whether the following statements are "True" or "False" by circling your answers below (each answer is worth 2 points) A) T F B) T F Cash collected from customers during the year amounted to $324,200. Cash paid to suppliers of goods and services (not including wage payments) during the year amounted to $215,100. c) T F Cash paid to employees for wages during the year amounted to $61,100. D) T F Income tax payments during the year amounted to $11,400. E) T F Cash received from depreciation during the year amounted to $12,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts