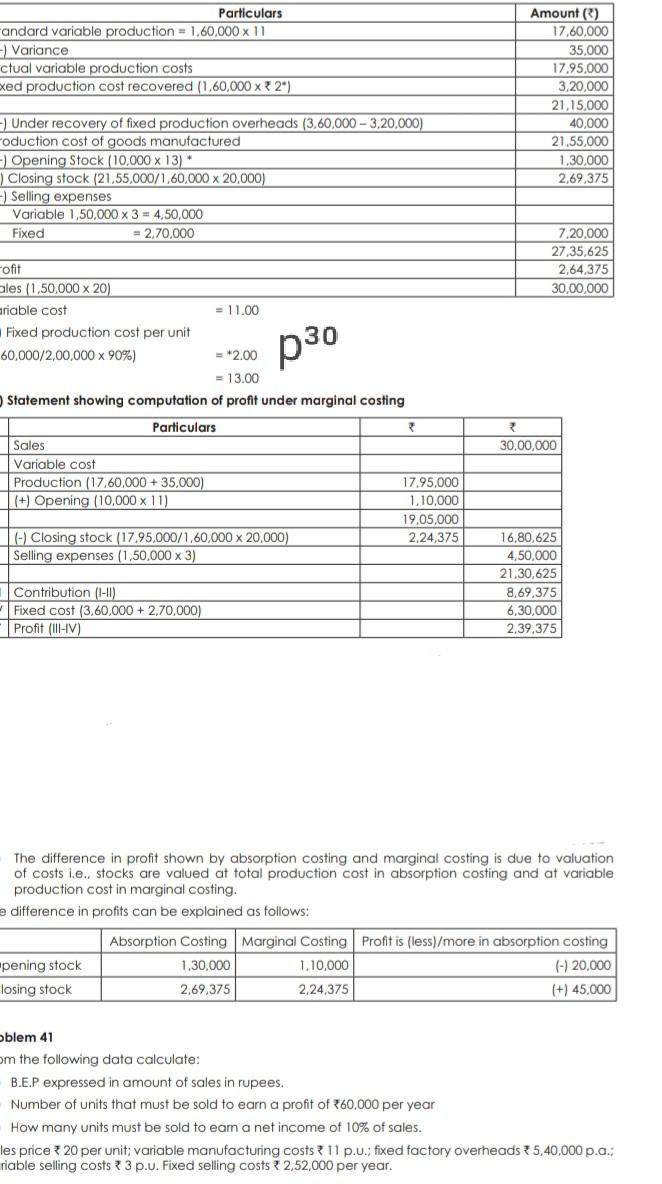

Question: Particulars andard variable production = 1,60,000 x 11 -) Variance ctual variable production costs xed production cost recovered (1.60,000 x 2) Amount() 17,60,000 35,000 17.95,000

Particulars andard variable production = 1,60,000 x 11 -) Variance ctual variable production costs xed production cost recovered (1.60,000 x 2") Amount() 17,60,000 35,000 17.95,000 3,20,000 21,15.000 40,000 21.55,000 1,30,000 2,69.375 - Under recovery of fixed production overheads (3.60,000 - 3,20,000) oduction cost of goods manufactured ) Opening Stock (10,000 x 13) Closing stock (21.55,000/1,60,000 x 20,000) -) Selling expenses Variable 1,50,000 x 3 = 4,50,000 Fixed = 2.70,000 7,20.000 27,35,625 2.64 375 30,00,000 p 30 ofit ales (1.50,000 x 20) ariable cost = 11.00 Fixed production cost per unit 60,000/2,00,000 X 90%) = *2.00 = 13.00 Statement showing computation of profit under marginal costing Particulars Sales Variable cost Production (17,60,000 + 35,000) 17,95,000 (+) Opening (10,000 x 11) 1,10,000 19.05,000 (-) Closing stock (17.95,000/1,60,000 x 20,000) 2,24,375 Selling expenses (1,50,000 x 3) 30,00,000 16,80,625 4,50.000 21.30,625 8.69,375 6.30.000 2,39,375 Contribution (1-10) Fixed cost (3,60,000+ 2.70,000) -Profit (I-IV) The difference in profit shown by absorption costing and marginal costing is due to valuation of costs i.e., stocks valued at total production cost in absorption costing and at variable production cost in marginal costing. e difference in profits can be explained as follows: pening stock losing stock Absorption Costing Marginal Costing Profit is (less)/more in absorption costing 1.30,000 1.10,000 (-) 20,000 2,69,375 2.24,375 (+) 45.000 oblem 41 om the following data calculate: B.E.P expressed in amount of sales in rupees. Number of units that must be sold to earn a profit of 60,000 per year How many units must be sold to eam a net income of 10% of sales. les price 20 per unit; variable manufacturing costs 11 p.U.: fixed factory overheads 5,40,000 p.a.: riable selling costs 3 p.u. Fixed selling costs 2,52,000 per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts