Question: Pleas answer the questions based on the supporting data provided. Thank you and I'll be sure to UPVOTE for your willingness to help. In the

Pleas answer the questions based on the supporting data provided. Thank you and I'll be sure to UPVOTE for your willingness to help.

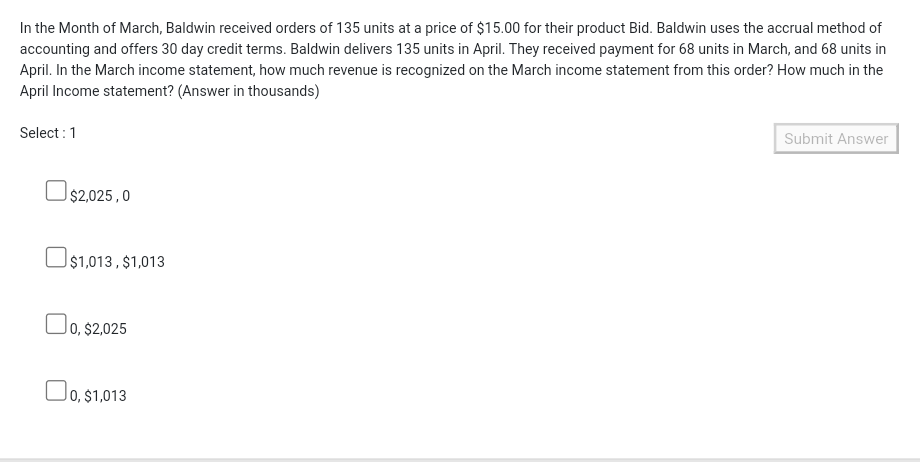

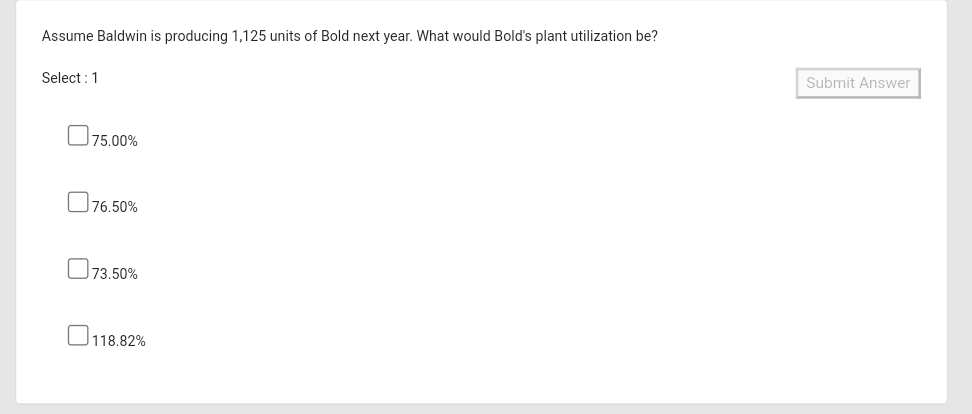

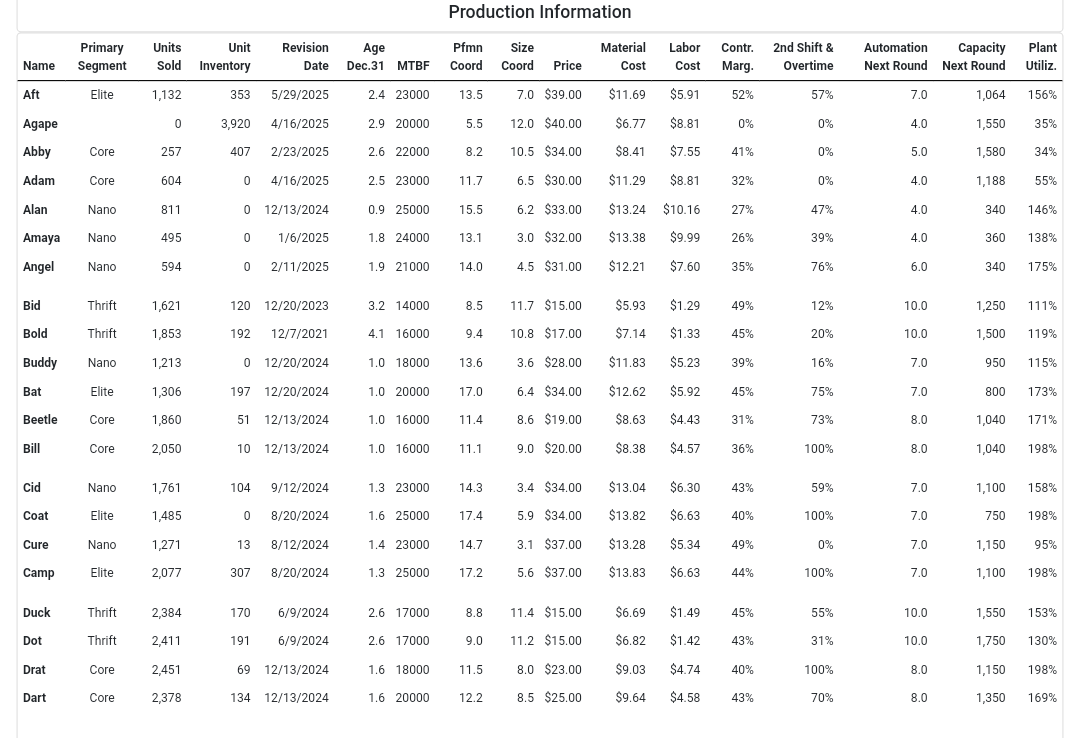

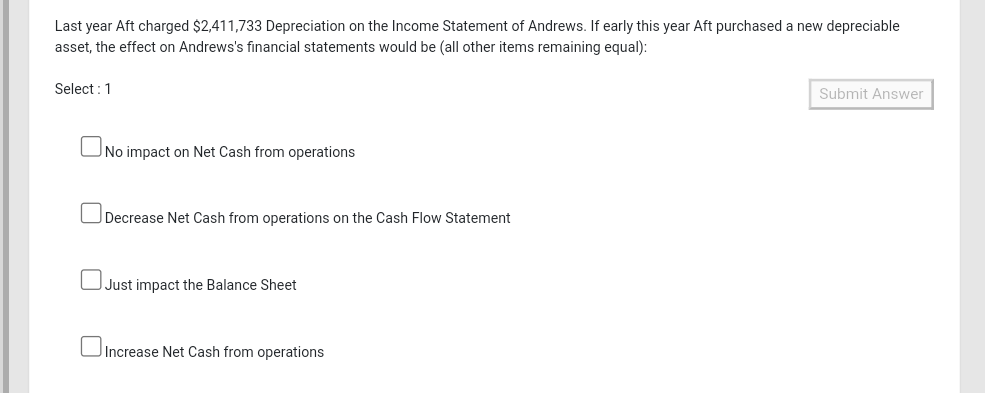

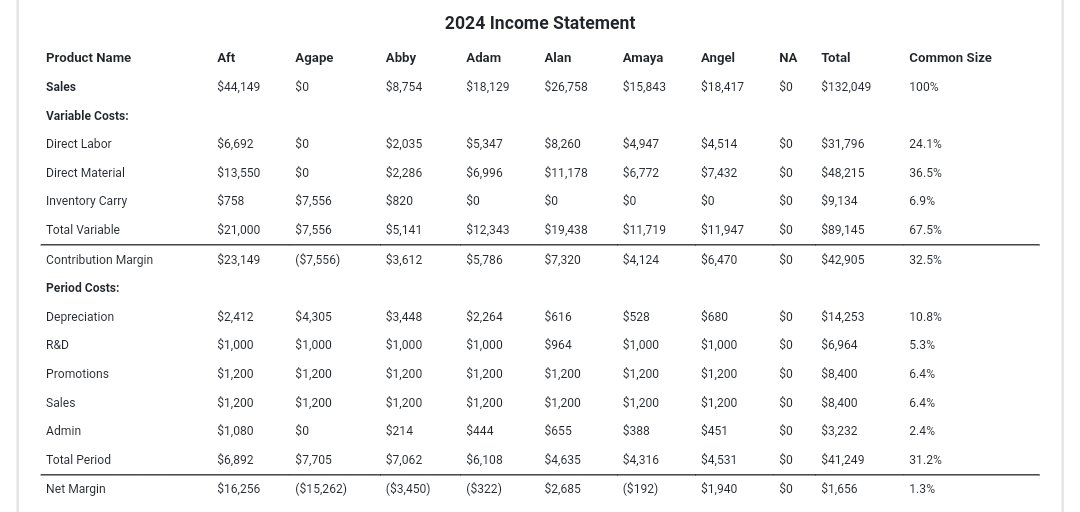

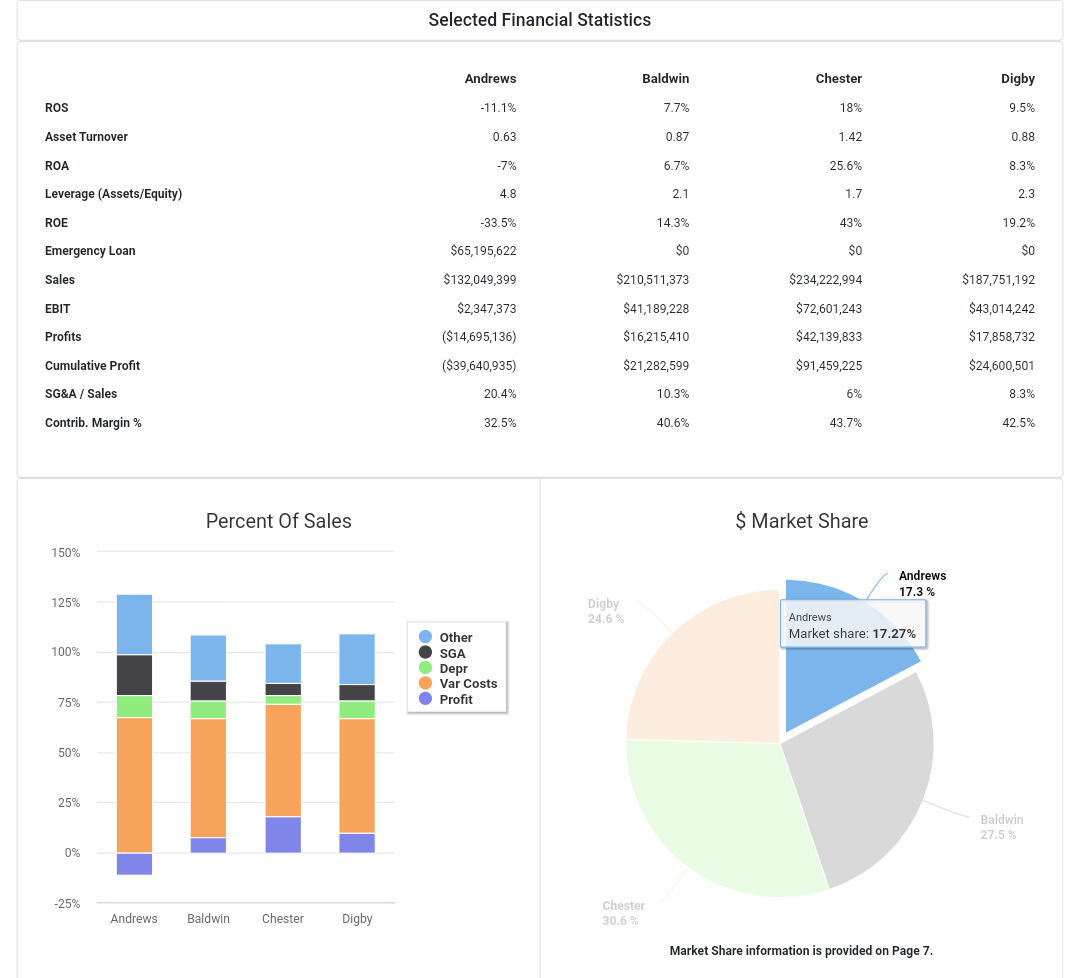

In the Month of March, Baldwin received orders of 135 units at a price of $15.00 for their product Bid. Baldwin uses the accrual method of accounting and offers 30 day credit terms. Baldwin delivers 135 units in April. They received payment for 68 units in March, and 68 units in April. In the March income statement, how much revenue is recognized on the March income statement from this order? How much in the April Income statement? (Answer in thousands) Select : 1 Submit Answer $2,025,0 $1,013, $1,013 O 0, $2,025 0,$1,013 Assume Baldwin is producing 1,125 units of Bold next year. What would Bold's plant utilization be? Select : 1 Submit Answer 75.00% 76.50% 73.50% 118.82% Production Information Primary Segment Units Unit Sold Inventory Revision Date Age Dec.31 MTBF Pfmn Size Coord Coord Price Material Cost Labor Cost Contr. Marg. 2nd Shift & Overtime Automation Capacity Next Round Next Round Plant Utiliz. Name Aft Elite 1,132 353 5/29/2025 2.4 23000 13.5 7.0 $39.00 $11.69 $5.91 52% 57% 7.0 1,064 156% 0 3,920 4/16/2025 2.9 20000 5.5 12.0 $40.00 $6.77 $8.81 0% 0% 4.0 1,550 35% Agape Abby Core 257 407 2/23/2025 2.6 22000 8.2 10.5 $34.00 $8.41 $7.55 41% 0% 5.0 1,580 34% Adam Core 604 0 4/16/2025 2.5 23000 11.7 6.5 $30.00 $11.29 $8.81 32% 0% 4.0 1,188 55% Alan Nano 811 0 12/13/2024 0.9 25000 15.5 6.2 $33.00 $13.24 $10.16 27% 47% 4.0 340 146% Amaya Nano 495 0 1/6/2025 1.8 24000 13.1 3.0 $32.00 $13.38 $9.99 26% 39% 4.0 360 138% Angel Nano 594 0 2/11/2025 1.9 21000 14.0 4.5 $31.00 $ 12.21 $7.60 35% 76% 6.0 340 175% Bid Thrift 1,621 120 12/20/2023 3.2 14000 8.5 11.7 $15.00 $5.93 $1.29 49% 12% 10.0 1,250 111% Bold Thrift 1,853 192 12/7/2021 4.1 16000 9.4 10.8 $17.00 $7.14 $1.33 45% 20% 10.0 1,500 119% Buddy Nano 1,213 0 12/20/2024 1.0 18000 13.6 3.6 $28.00 $11.83 $5.23 39% 16% 7.0 950 115% Bat Elite 1,306 197 12/20/2024 1.0 20000 17.0 6.4 $34.00 $12.62 $5.92 45% 75% 7.0 800 173% Beetle Core 1,860 51 12/13/2024 1.0 16000 11.4 8.6 $19.00 $8.63 $4.43 31% 73% 8.0 1,040 171% Bill 040 Core 2,050 10 12/13/2024 1.0 16000 11.1 9.0 $20.00 $8.38 $4.57 36% 100% 8.0 1,040 198% Cid Nano 1,761 104 9/12/2024 1.3 23000 14.3 3.4 $34.00 $13.04 $6.30 43% 59% 7.0 1,100 158% Coat Elite 1,485 0 8/20/2024 1.6 25000 17.4 5.9 $34.00 $13.82 $6.63 40% 100% 7.0 750 198% Cure Nano 1,271 13 8/12/2024 1.4 23000 14.7 3.1 $37.00 $13.28 $5.34 49% 0% 7.0 1,150 95% Camp Elite 2,077 307 8/20/2024 1.3 25000 17.2 5.6 $37.00 $13.83 $ $6.63 44% 100% 7.0 1,100 198% Duck Thrift 2,384 170 6/9/2024 2.6 17000 8.8 11.4 $15.00 $6.69 $1.49 45% 55% 10.0 1,550 153% Dot Thrift 2,411 191 6/9/2024 2.6 17000 9.0 11.2 $15.00 $6.82 $1.42 43% 31% 10.0 1,750 130% Drat Core 2,451 69 12/13/2024 1.6 18000 11.5 8.0 $23.00 $9.03 $4.74 40% 100% 8.0 1,150 198% Dart Core 2,378 134 12/13/2024 1.6 20000 12.2. 8.5 $25.00 $9.64 $4.58 43% 70% 8.0 1,350 169% Last year Aft charged $2,411,733 Depreciation on the Income Statement of Andrews. If early this year Aft purchased a new depreciable asset, the effect on Andrews's financial statements would be all other items remaining equal): Select: 1 Submit Answer No impact on Net Cash from operations Decrease Net Cash from operations on the Cash Flow Statement Just impact the Balance Sheet Increase Net Cash from operations 2024 Income Statement Product Name Aft Agape Abby Adam Alan Amaya Angel NA Total Common Size Sales $44,149 $0 $8,754 $18,129 $26,758 $15,843 $18,417 $0 $0 $132,049 100% Variable Costs: : Direct Labor $6,692 $ SO $2,035 $5,347 $8,260 $4,947 $4,514 SO $ $31,796 24.1% Direct Material $13,550 $0 $2,286 $6,996 $11,178 $6,772 $7,432 0 $0 $48,215 36.5% Inventory Carry $758 $7,556 $820 $0 $0 $0 $0 $0 $9,134 6.9% Total Variable $21,000 $7,556 $5,141 $12,343 $19,438 $11,719 $11,947 $0 $89,145 67.5% Contribution Margin $23,149 ($7,556) $3,612 $5,786 $7,320 $4,124 $6,470 $0 $42,905 32.5% Period Costs: Depreciation $2,412 $4,305 $3,448 $2,264 $616 $528 $680 $0 $14,253 10.8% R&D $1,000 $1,000 $1,000 $1,000 $964 $1,000 $0 $6,964 5.3% Promotions $1,200 $1,200 $1,200 $1,200 $1,200 $1,000 $1,200 $1,200 $1,200 $0 $8,400 6.4% Sales $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $0 $8,400 6.4% Admin $1,080 $0 $214 $444 $655 $388 $451 0 $0 $3,232 2.4% Total Period $6,892 $7,705 $7,062 $6,108 $4,635 $4,316 $4,531 $0 $41,249 31.2% Net Margin $16,256 ($15,262) ($3,450) ($322) $2,685 ($192) $1,940 $0 $1,656 1.3% Which company has the least efficient SG&A/Sales ratio? Select:1 Andrews Baldwin Digby Chester Selected Financial Statistics Andrews Baldwin Chester Digby ROS -11.1% 7.7% 18% 9.5% Asset Turnover 0.63 0.87 1.42 0.88 ROA -7% 6.7% 25.6% 8.3% Leverage (Assets/Equity) 4.8 2.1 1.7 2.3 ROE -33.5% 14.3% 43% 19.2% Emergency Loan $65,195,622 $0 0 $0 $0 Sales $132,049,399 $210,511,373 $234,222,994 $187,751,192 EBIT $2,347,373 $41,189,228 $72,601,243 $43,014,242 Profits ($14,695,136) $16,215,410 $42,139,833 $17,858,732 Cumulative Profit ($39,640,935) $21,282,599 $91,459,225 $24,600,501 SG&A / Sales 20.4% 10.3% 6% 8.3% Contrib. Margin % 32.5% 40.6% 43.7% 42.5% Percent Of Sales $ Market Share 150% Andrews 17.3% 125% Digby 24.6% Andrews Market share: 17.27% 100% Other SGA Depr Var Costs Profit 75% 50% 25% Baldwin 27.5% 0% -25% Andrews Baldwin Chester Digby Chester 30.6% Market Share information is provided on Page 7Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts