Question: Please answer 1-5 please !!!!!!! Problem IV (12 points) Here are the risk and return estimates for the T-Note (#1) and the S&P 500 (#2)

Please answer 1-5 please !!!!!!!

Please answer 1-5 please !!!!!!!

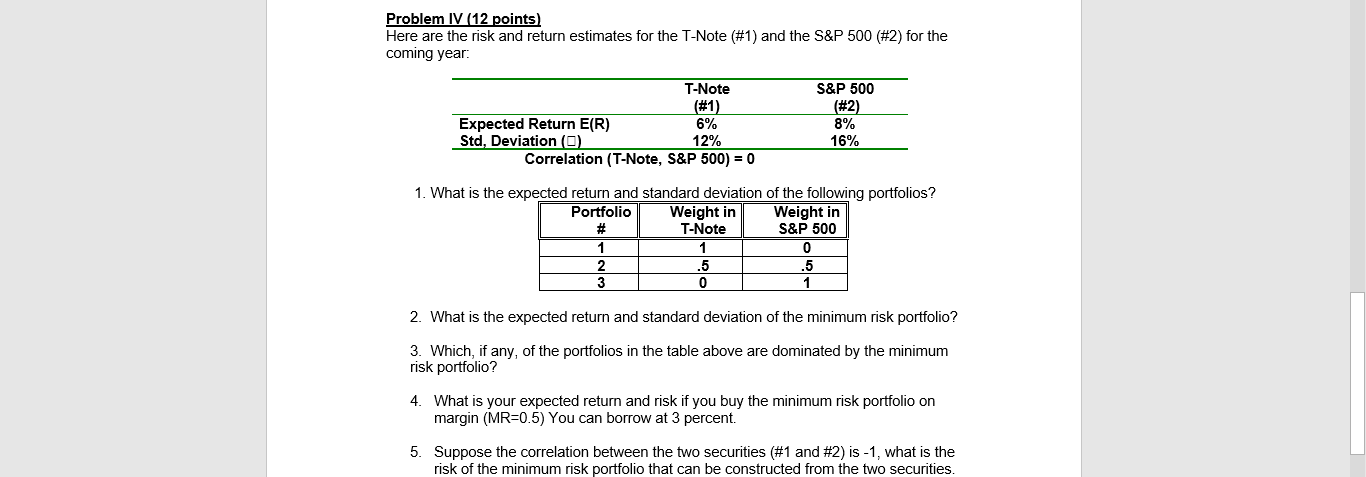

Problem IV (12 points) Here are the risk and return estimates for the T-Note (#1) and the S&P 500 (#2) for the coming year: T-Note (#1) Expected Return E(R) 6% Std, Deviation O. 12% Correlation (T-Note, S&P 500) = 0 S&P 500 (#2) 8% 16% 1. What is the expected return and standard deviation of the following portfolios? Portfolio Weight in | Weight in T-Note S&P 500 2. What is the expected return and standard deviation of the minimum risk portfolio? 3. Which, if any, of the portfolios in the table above are dominated by the minimum risk portfolio? 4. What is your expected return and risk if you buy the minimum risk portfolio on margin (MR=0.5) You can borrow at 3 percent. 5. Suppose the correlation between the two securities (#1 and #2) is -1, what is the risk of the minimum risk portfolio that can be constructed from the two securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts