Question: please answer all and show work please 6. If annualized interest rates in the U.S. and Switzerland are 10% and 4%, respectively, and the 90

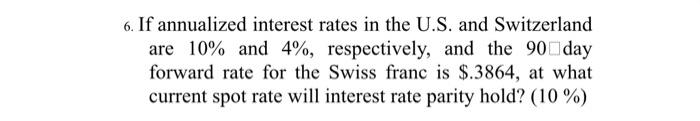

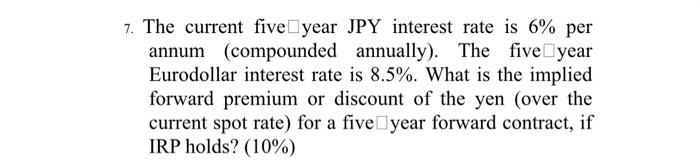

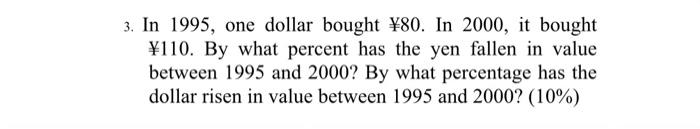

6. If annualized interest rates in the U.S. and Switzerland are 10% and 4%, respectively, and the 90 day forward rate for the Swiss franc is $.3864, at what current spot rate will interest rate parity hold? (10 %) 7. The current five year JPY interest rate is 6% per annum (compounded annually). The five year Eurodollar interest rate is 8.5%. What is the implied forward premium or discount of the yen (over the current spot rate) for a five year forward contract, if IRP holds? (10%) 3. In 1995, one dollar bought 80. In 2000, it bought 110. By what percent has the yen fallen in value between 1995 and 2000? By what percentage has the dollar risen in value between 1995 and 2000? (10%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts