Question: PLEASE ANSWER ALL QUESTION. 14. A self-employed attorney uses a country club for entertainment and client meetings. During 2021, the attorney spends amounts as set

PLEASE ANSWER ALL QUESTION.

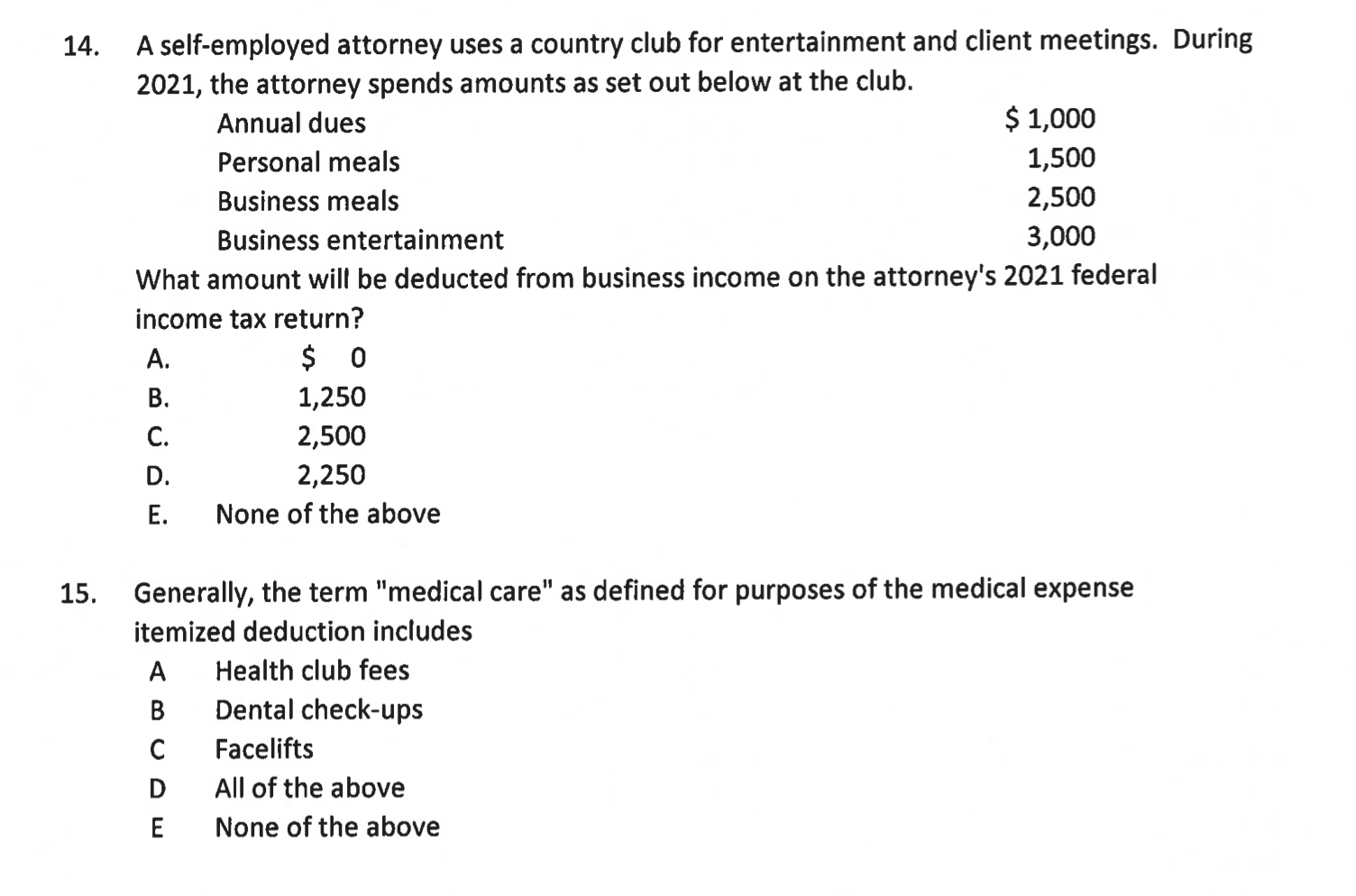

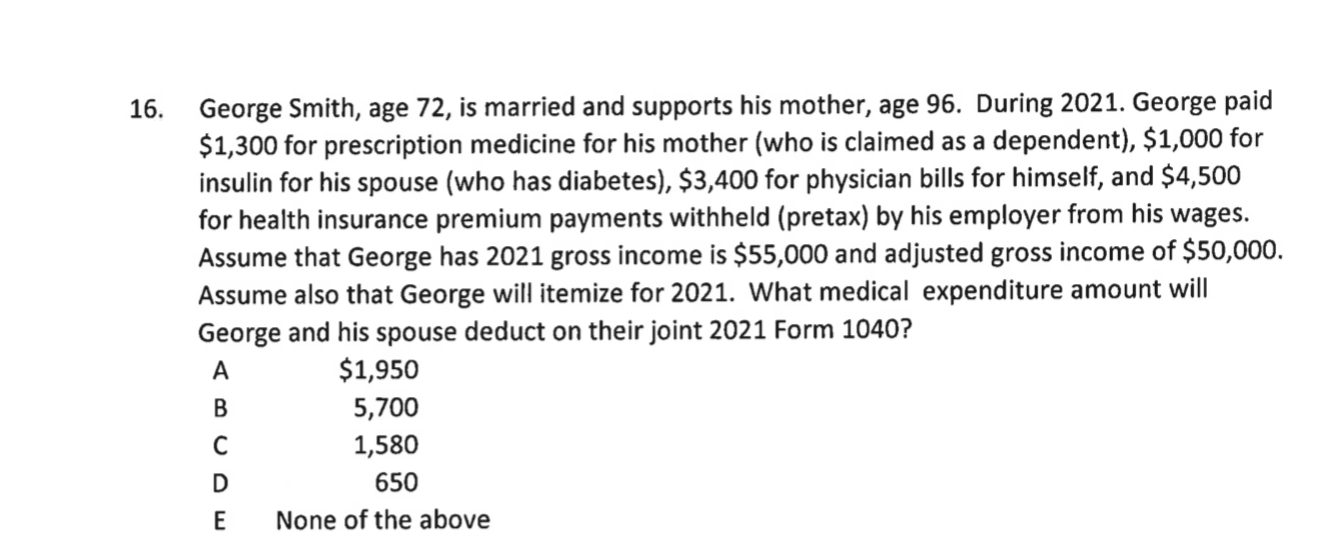

14. A self-employed attorney uses a country club for entertainment and client meetings. During 2021, the attorney spends amounts as set out below at the club. Annual dues $ 1,000 Personal meals 1,500 Business meals 2,500 Business entertainment 3,000 What amount will be deducted from business income on the attorney's 2021 federal income tax return? A. $0 B. 1,250 C. 2,500 D. 2,250 E. None of the above 15. Generally, the term "medical care" as defined for purposes of the medical expense itemized deduction includes A Health club fees B Dental check-ups C Facelifts D All of the above E None of the above 16. George Smith, age 72, is married and supports his mother, age 96. During 2021. George paid $1,300 for prescription medicine for his mother (who is claimed as a dependent), $1,000 for insulin for his spouse (who has diabetes), $3,400 for physician bills for himself, and $4,500 for health insurance premium payments withheld (pretax) by his employer from his wages. Assume that George has 2021 gross income is $55,000 and adjusted gross income of $50,000. Assume also that George will itemize for 2021. What medical expenditure amount will George and his spouse deduct on their joint 2021 Form 1040? A $1,950 B 5,700 C 1,580 D 650 E None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts