Question: Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final

Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final answer and then round it to the nearest $10.

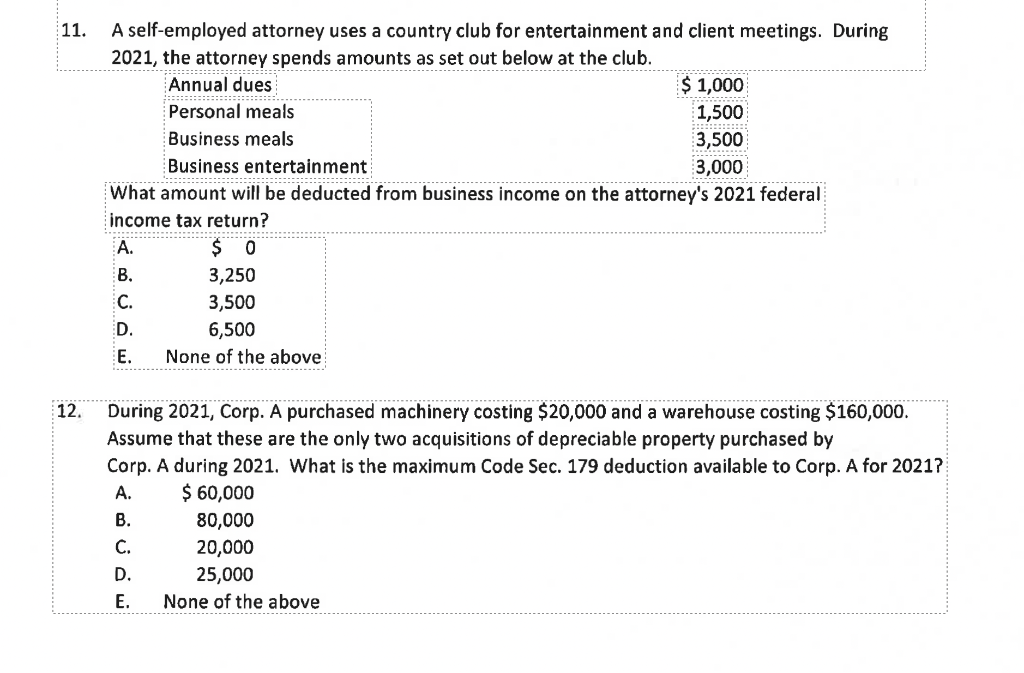

1. A self-employed attorney uses a country club for entertainment and client meetings. During 2021 , the attornev spends amounts as set out below at the club. What amount will be deducted from business income on the attorney's 2021 federal inrome tax return? During 2021 , Corp. A purchased machinery costing $20,000 and a warehouse costing $160,000. Assume that these are the only two acquisitions of depreciable property purchased by Corp. A during 2021. What is the maximum Code Sec. 179 deduction available to Corp. A for 2021? A. $60,000 B. 80,000 C. 20,000 D. 25,000 E. None of the above 1. A self-employed attorney uses a country club for entertainment and client meetings. During 2021 , the attornev spends amounts as set out below at the club. What amount will be deducted from business income on the attorney's 2021 federal inrome tax return? During 2021 , Corp. A purchased machinery costing $20,000 and a warehouse costing $160,000. Assume that these are the only two acquisitions of depreciable property purchased by Corp. A during 2021. What is the maximum Code Sec. 179 deduction available to Corp. A for 2021? A. $60,000 B. 80,000 C. 20,000 D. 25,000 E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts