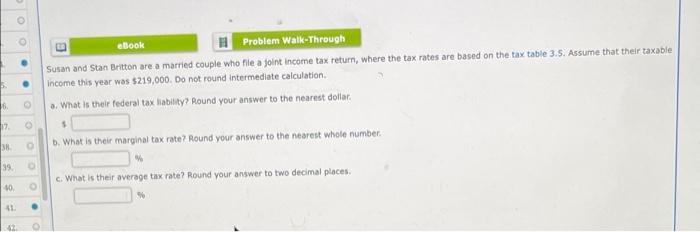

Question: PLEASE ANSWER ALL QUESTIONS o E eBook Problem Walk-Through Susan and Stan Britton are a married couple who nile a joint Income tax return, where

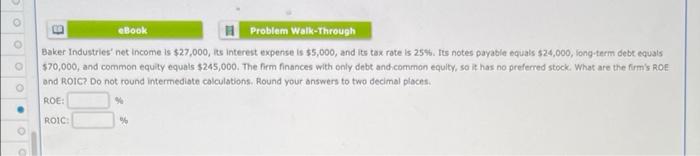

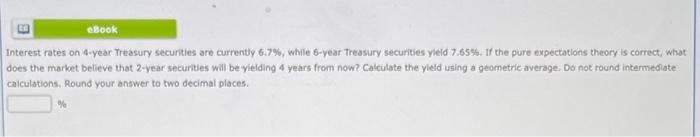

o E eBook Problem Walk-Through Susan and Stan Britton are a married couple who nile a joint Income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $219,000. Do not round Intermediate calculation a. What is their federal tax liability? Round your answer to the nearest dollar. 6. 12 b. What is their marginal tax rate? Round your answer to the nearest whole number. 39 c. What is their average tax rate? Round your answer to two decimal places 10 11 eBook Problem Walk-Through Baker Industries' net Income is $27,000, its interest expense is $5,000, and its tax rate is 25%. Tis notes payable equals $24,000, long-term debt equals $70,000, and common equity equals $245,000. The firm finances with only debt and common equilty, so it has no preferred stock. What are the firm's ROE and ROIC? Do not found intermediate calculations. Round your answers to two decimal places ROE: ROIC eBook Interest rates on 4-year Treasury securities are currently 6.7%, while 6-year Treasury securities yield 7.65%. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round intermediate calculations, Round your answer to two decimal places %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts