Question: please answer all questions Question 3 (10 points) If the return on stock A in year 1 was 16 %, in year 2 was 18

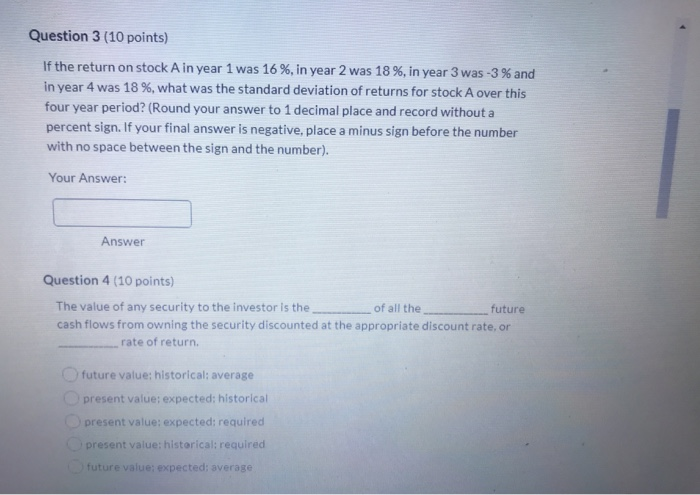

Question 3 (10 points) If the return on stock A in year 1 was 16 %, in year 2 was 18 %, in year 3 was -3% and in year 4 was 18 %, what was the standard deviation of returns for stock A over this four year period? (Round your answer to 1 decimal place and record without a percent sign. If your final answer is negative, place a minus sign before the number with no space between the sign and the number). Your Answer: Answer Question 4 (10 points) The value of any security to the investor is the of all the __ future cash flows from owning the security discounted at the appropriate discount rate, or rate of return future value: historical: average present value; expected: historical present value: expected: required present value: historical: required future value; expected: average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts