Question: please answer !!! all three Question 24 (10 points) Astro Inc. will pay a $2.00 dividend next year. The dividend will grow a 4% per

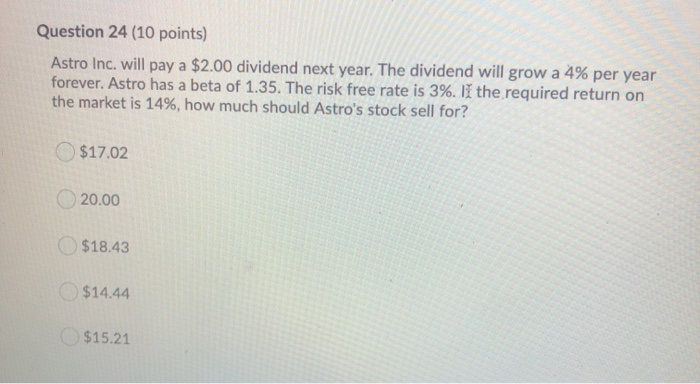

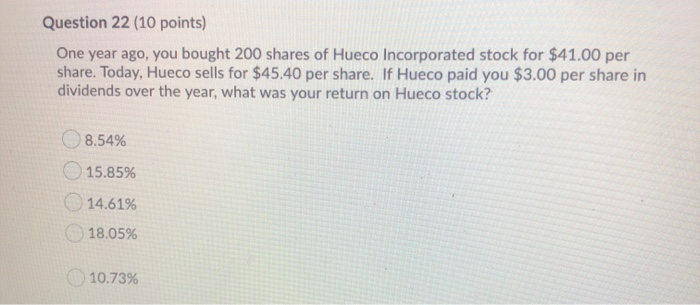

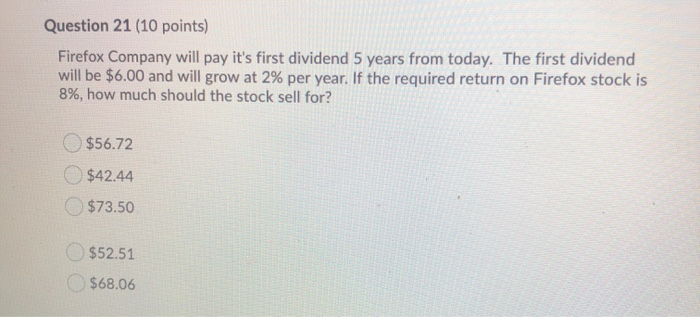

Question 24 (10 points) Astro Inc. will pay a $2.00 dividend next year. The dividend will grow a 4% per year forever. Astro has a beta of 1.35. The risk free rate is 3%. If the required return on the market is 14%, how much should Astro's stock sell for? $17.02 20.00 $18.43 $14.44 $15.21 Question 22 (10 points) One year ago, you bought 200 shares of Hueco Incorporated stock for $41.00 per share. Today, Hueco sells for $45.40 per share. If Hueco paid you $3.00 per share in dividends over the year, what was your return on Hueco stock? 8.54% 15.85% 14.61% 18.05% 10.73% Question 21 (10 points) Firefox Company will pay it's first dividend 5 years from today. The first dividend will be $6.00 and will grow at 2% per year. If the required return on Firefox stock is 8%, how much should the stock sell for? $56.72 $42.44 $73.50 $52.51 $68.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts