Question: please answer all The expected rates of return for Stocks A, B, and Care 12, .08, and .05 respectively. The risk-free rate is .03 and

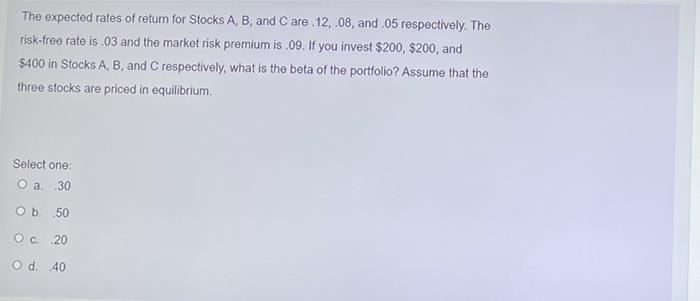

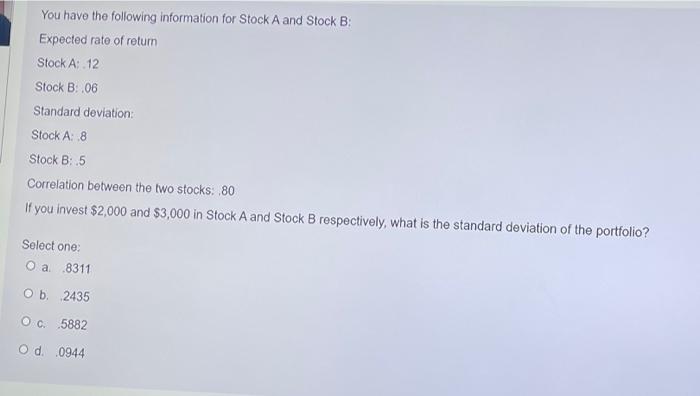

The expected rates of return for Stocks A, B, and Care 12, .08, and .05 respectively. The risk-free rate is .03 and the market risk premium is .09. If you invest $200, $200, and $400 in Stocks A, B, and respectively, what is the beta of the portfolio? Assume that the three stocks are priced in equilibrium. Select one: O a. 30 Ob 50 OC 20 Od 40 You have the following information for Stock A and Stock B: Expected rate of retum Stock A: 12 Stock B:06 Standard deviation: Stock A: 8 Stock B: 5 Correlation between the two stocks. 80 If you invest $2,000 and $3,000 in Stock A and Stock B respectively, what is the standard deviation of the portfolio? Select one: O a 8311 Ob 2435 Oc5882 Od 0944

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts