Question: PLEASE ANSWER ALL THE QUESTIONS AND LABEL THEM WITH THE CORRESPONDING LETTER PLEASE IF THE ANSWERS I HAVE CURRENTLY ARE WRONG PLEASE FEEL FREE TO

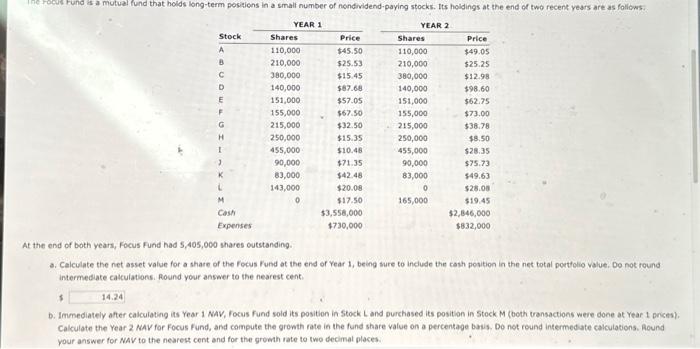

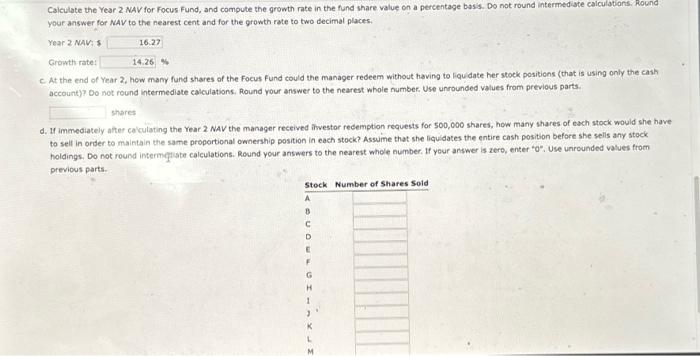

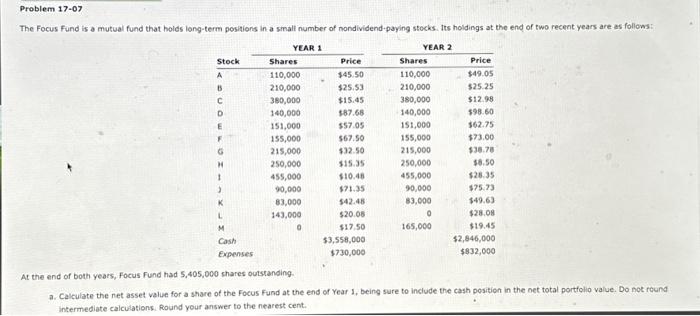

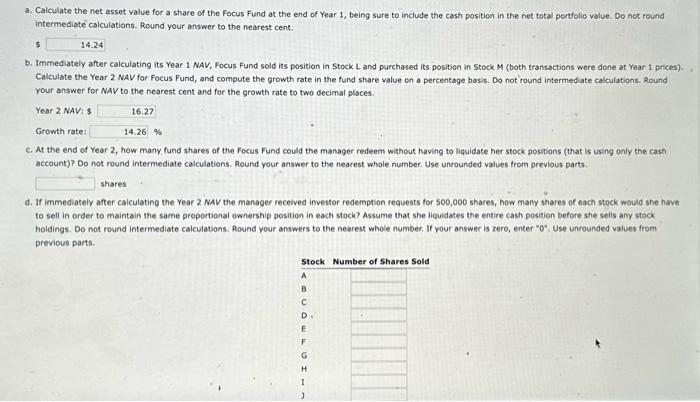

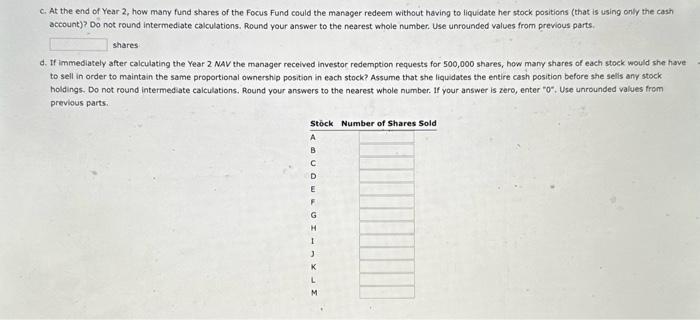

at the end of both years, Focus Fund had 5,405,000 shares outstanding. a. Calculate the net asset value for a share of the Focus Fund at the end of Year 1 , being sure to include the cash potition in the net total portfolio value. Do not round intermediate calculations. Round your answer to the nearest cent: b. Immediately after calculating its Year 1 NAV, Focus fund sold its position in Stock L and purchased its position in Stock M (both vansactions were done at Year 1 pnices). Calculate the Year 2 NAV for Focus Fund, and compute the growth rate in the fund share value on a percentage basis, Do not round intermedate calculations. Round your answer for NAV to the nearest cent and for the growth rate to two decimal places. Calculate the Year 2 NAV for Focus Fund, and compute the growth rate in the fund share value on a percentage basis. Do not round intermediate Calcul3tioris, Hound your answer for NAV to the nearest cent and for the growth rate to two decimal places. Year 2 Natis Growthrate: C. At the end of Year 2, how mamy fund shares of the Focus fund could the manager redeem without having to loudate her stock positions (that is using only the cash aceount)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrounded values from previous parts. shares d. If immediately after cakulating the Year 2 NAV the manager received ihvestor redemption requests for 500,000 shares, how many shares of each stock would she have to self in order to maintain the same proportional ownership position in each stock? Assume that she liquidates the entire cash position before she selis any stock holdings. Do not round intermgtiate calculations. Round your answers to the nearest whole aumber. If your answer is zero, enter to", Use unrounded values from. At the end of both years, Focus Fund had 5,405,000 shares outstanding. a. Calculate the net asset value for a share of the Focus Fund at the end of Year 1, being sure to include the cash position in the net total portfolio value. Do not reung intermediate calculations, Round your answer to the nearest cent. a. Calculate the net asset value for a share of the Focus Fund at the end of Year 1 , being sure to include the cash position in the net total portfolio value. Do not round intemediate calculations. Round your answer to the nearest cent: $ b. Immediately after calculating its Year 1 NAV, Focus Fund sold its position in Stock L and purchased its position in Stock M (both transactions were done at Year 1 prices) Calculate the Year 2 NAV for Focus Fund, and compute the growth rate in the fund share value on a percentage basis. Do not round intermediate calculations. Round your answer for NAV to the nearest cent and for the growth rate to two decimal places. Year 2NAV:$ Growth rate: c. At the end of Year 2, how many fund shares of the Focus Fund could the manager redeem without having to liquidate her stock positions (that is using only the cash account)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrounded values from previous parts. shares d. If immediately after calculating the Year 2 NAV the manager received investor redemption requests for 500,000 shares, how many shares of each stock would she have to sell in order to maintain the same proportional ownership position in each stock? Assume that she liquidates the entire cash position before she sells amy stock holdings. Do not round intermediate calculations. Round your answers to the nearest whole number, If your answer is rero, enter "0", Use unrounded values from c. At the end of Year 2, how mamy fund shares of the Focus Fund could the manager redeem without having to liquidate her stock positions (that is ising only the cash account)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrounded values from previous parts shares d. If immediately after calculating the Year 2 NAV the manager received investor redemption requests for 500,000 shares, how many shares of each stock would she have to sell in order to maintain the same proportional ownership position in each stock? Assume that she liquidates the entire cash position before she sells any stock holdings. Do not round intermediate caiculations. Round your answers to the nearest whole number. If your answer is zero, enter ro", Use unrounded values from previous parts. at the end of both years, Focus Fund had 5,405,000 shares outstanding. a. Calculate the net asset value for a share of the Focus Fund at the end of Year 1 , being sure to include the cash potition in the net total portfolio value. Do not round intermediate calculations. Round your answer to the nearest cent: b. Immediately after calculating its Year 1 NAV, Focus fund sold its position in Stock L and purchased its position in Stock M (both vansactions were done at Year 1 pnices). Calculate the Year 2 NAV for Focus Fund, and compute the growth rate in the fund share value on a percentage basis, Do not round intermedate calculations. Round your answer for NAV to the nearest cent and for the growth rate to two decimal places. Calculate the Year 2 NAV for Focus Fund, and compute the growth rate in the fund share value on a percentage basis. Do not round intermediate Calcul3tioris, Hound your answer for NAV to the nearest cent and for the growth rate to two decimal places. Year 2 Natis Growthrate: C. At the end of Year 2, how mamy fund shares of the Focus fund could the manager redeem without having to loudate her stock positions (that is using only the cash aceount)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrounded values from previous parts. shares d. If immediately after cakulating the Year 2 NAV the manager received ihvestor redemption requests for 500,000 shares, how many shares of each stock would she have to self in order to maintain the same proportional ownership position in each stock? Assume that she liquidates the entire cash position before she selis any stock holdings. Do not round intermgtiate calculations. Round your answers to the nearest whole aumber. If your answer is zero, enter to", Use unrounded values from. At the end of both years, Focus Fund had 5,405,000 shares outstanding. a. Calculate the net asset value for a share of the Focus Fund at the end of Year 1, being sure to include the cash position in the net total portfolio value. Do not reung intermediate calculations, Round your answer to the nearest cent. a. Calculate the net asset value for a share of the Focus Fund at the end of Year 1 , being sure to include the cash position in the net total portfolio value. Do not round intemediate calculations. Round your answer to the nearest cent: $ b. Immediately after calculating its Year 1 NAV, Focus Fund sold its position in Stock L and purchased its position in Stock M (both transactions were done at Year 1 prices) Calculate the Year 2 NAV for Focus Fund, and compute the growth rate in the fund share value on a percentage basis. Do not round intermediate calculations. Round your answer for NAV to the nearest cent and for the growth rate to two decimal places. Year 2NAV:$ Growth rate: c. At the end of Year 2, how many fund shares of the Focus Fund could the manager redeem without having to liquidate her stock positions (that is using only the cash account)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrounded values from previous parts. shares d. If immediately after calculating the Year 2 NAV the manager received investor redemption requests for 500,000 shares, how many shares of each stock would she have to sell in order to maintain the same proportional ownership position in each stock? Assume that she liquidates the entire cash position before she sells amy stock holdings. Do not round intermediate calculations. Round your answers to the nearest whole number, If your answer is rero, enter "0", Use unrounded values from c. At the end of Year 2, how mamy fund shares of the Focus Fund could the manager redeem without having to liquidate her stock positions (that is ising only the cash account)? Do not round intermediate calculations. Round your answer to the nearest whole number. Use unrounded values from previous parts shares d. If immediately after calculating the Year 2 NAV the manager received investor redemption requests for 500,000 shares, how many shares of each stock would she have to sell in order to maintain the same proportional ownership position in each stock? Assume that she liquidates the entire cash position before she sells any stock holdings. Do not round intermediate caiculations. Round your answers to the nearest whole number. If your answer is zero, enter ro", Use unrounded values from previous parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts