Question: please answer as soon as possible, dear expert. Question- 5 (10 points) The market price of a security is $75. Its expected rate of return

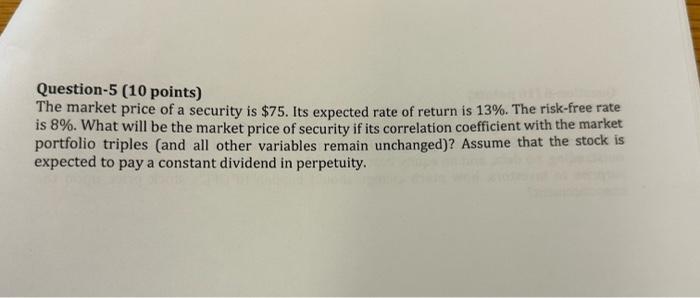

Question- 5 (10 points) The market price of a security is $75. Its expected rate of return is 13%. The risk-free rate is 8%. What will be the market price of security if its correlation coefficient with the market portfolio triples (and all other variables remain unchanged)? Assume that the stock is expected to pay a constant dividend in perpetuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts