Question: please answer asap will give you a 4:45 Answer 1 of 1 Done _Part 1) The CVP structure is given as below: CVP Statement -

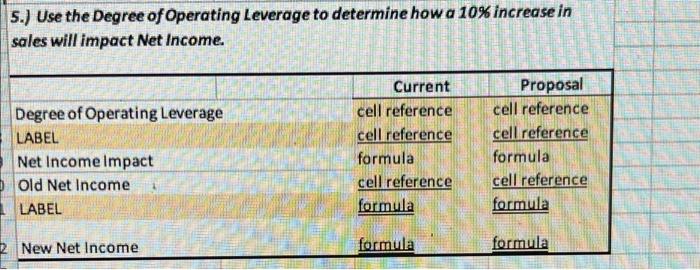

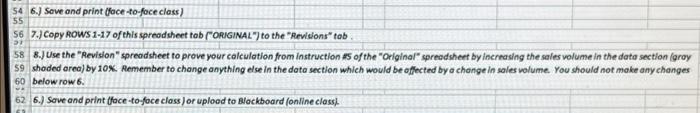

4:45 Answer 1 of 1 Done _Part 1) The CVP structure is given as below: CVP Statement - Current Structure Total PerUnit Percentage Sales 2.000.000 100 100 Variable costs 400,00 20 Contribution Margin 1.600.000 Fixed Costi 900,000 Net Operating Income 570.00 CVP Statement Proposed Structure Total PerUnit Perce Sales 2,000,000 100 100 Variable Costs 700.000 35 1944 Contributions Marcin 300,000 65 658 Fixed Costa 600.000 Net Operating Income 5700,000 _Part 2) The breakeven point in units and dollars under each structure can be calculated with the use of formulas given below Breakeven Point (in Units) = Fixed Cost/Contribution Margin Per Unit Breakeven Point (in Dollars) = Fixed Cost Contribution Margin Percentage --- Substituting values in the above formula, we get, Current Structure Breaiceven Point (in Units) = 900,000/80 = 11,250 units Breakceven Point in Dollars) 900,000/80%= 51,125,000 - Proposed Structure Breakeven Point (in Units) = 600,000/US = 9,230.77 units or 9,231 units Breakeven Point (in Dollars) 600,000/65% $923,076.92 or $923,077 Part 3) Based on the calculations made in Part 1) and Part 21, we can observe that the net operating income has remained constant at $700,000 under both the current and proposed structure However, the breakerven point in both units and dollars has declined under the proposed structure. It is because of the reduction in the value of filed costs from $900,000 to 5600,000 which is proportionately more than the increase in variable cost per unit - Part 4) The degree of operating leverage can be calculated with the use of following formula Degree of Operating Leverage Contribution Margintie Operating income Using the values calculated in Part 1), we get Degree of Operating Leverage (Current Structure) = 1,600,000/700,000 = 2.29 Degree of Operating Leverage (Proposed Structure) 1300,000/700,000 1.86 $ 5.) Use the Degree of Operating Leverage to determine how a 10% increase in sales will impact Net Income. Is 31 ol NA One SI GT 1 13 Degree of Operating Leverage LABEL Net Income Impact Old Net Income LABEL Current cell reference cell reference formula cell reference formula Proposal cell reference cell reference formula cell reference formula 2 New Net Income formula formula 55 54 6.) Sewe and print (face-to-face class) 56 7.) Copy ROWS 1-17 of this spreadsheet tob ("ORIGINAL") to the "Revisions" tob 58 8.) Use the "Revision" spreadsheet to prove your calculation from instruction #5 of the "Original spreadsheet by increasing the sales volume in the data section (gray $9 shoded area) by 10%. Remember to change anything else in the data section which would be affected by a change in sales volume. You should not make any changes 60 below row 6. 62 6.) Sove and print (face-to-face class) or upload to Blackboard (online classi 4:45 Answer 1 of 1 Done _Part 1) The CVP structure is given as below: CVP Statement - Current Structure Total PerUnit Percentage Sales 2.000.000 100 100 Variable costs 400,00 20 Contribution Margin 1.600.000 Fixed Costi 900,000 Net Operating Income 570.00 CVP Statement Proposed Structure Total PerUnit Perce Sales 2,000,000 100 100 Variable Costs 700.000 35 1944 Contributions Marcin 300,000 65 658 Fixed Costa 600.000 Net Operating Income 5700,000 _Part 2) The breakeven point in units and dollars under each structure can be calculated with the use of formulas given below Breakeven Point (in Units) = Fixed Cost/Contribution Margin Per Unit Breakeven Point (in Dollars) = Fixed Cost Contribution Margin Percentage --- Substituting values in the above formula, we get, Current Structure Breaiceven Point (in Units) = 900,000/80 = 11,250 units Breakceven Point in Dollars) 900,000/80%= 51,125,000 - Proposed Structure Breakeven Point (in Units) = 600,000/US = 9,230.77 units or 9,231 units Breakeven Point (in Dollars) 600,000/65% $923,076.92 or $923,077 Part 3) Based on the calculations made in Part 1) and Part 21, we can observe that the net operating income has remained constant at $700,000 under both the current and proposed structure However, the breakerven point in both units and dollars has declined under the proposed structure. It is because of the reduction in the value of filed costs from $900,000 to 5600,000 which is proportionately more than the increase in variable cost per unit - Part 4) The degree of operating leverage can be calculated with the use of following formula Degree of Operating Leverage Contribution Margintie Operating income Using the values calculated in Part 1), we get Degree of Operating Leverage (Current Structure) = 1,600,000/700,000 = 2.29 Degree of Operating Leverage (Proposed Structure) 1300,000/700,000 1.86 $ 5.) Use the Degree of Operating Leverage to determine how a 10% increase in sales will impact Net Income. Is 31 ol NA One SI GT 1 13 Degree of Operating Leverage LABEL Net Income Impact Old Net Income LABEL Current cell reference cell reference formula cell reference formula Proposal cell reference cell reference formula cell reference formula 2 New Net Income formula formula 55 54 6.) Sewe and print (face-to-face class) 56 7.) Copy ROWS 1-17 of this spreadsheet tob ("ORIGINAL") to the "Revisions" tob 58 8.) Use the "Revision" spreadsheet to prove your calculation from instruction #5 of the "Original spreadsheet by increasing the sales volume in the data section (gray $9 shoded area) by 10%. Remember to change anything else in the data section which would be affected by a change in sales volume. You should not make any changes 60 below row 6. 62 6.) Sove and print (face-to-face class) or upload to Blackboard (online classi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts